Supreme Court refrains from Recalling Its Judgment Directing RBI To Disclose Loan Defaulters List

The Supreme Court (SC) on 28 April 2021, in the case titled Reserve Bank of India [Applicant(s)] v. Jayantilal N. Mistry;

Supreme Court refrains from Recalling Its Judgment Directing RBI To Disclose Loan Defaulters List The Supreme Court (SC) on 28 April 2021, in the case titled Reserve Bank of India [Applicant(s)] v. Jayantilal N. Mistry & Anr. [Respondent(s)] dismissed a joint plea by the Central Government and 10 other banks seeking a recall of the 2015 judgment. The Court directed the Reserve Bank of...

Supreme Court refrains from Recalling Its Judgment Directing RBI To Disclose Loan Defaulters List

The Supreme Court (SC) on 28 April 2021, in the case titled Reserve Bank of India [Applicant(s)] v. Jayantilal N. Mistry & Anr. [Respondent(s)] dismissed a joint plea by the Central Government and 10 other banks seeking a recall of the 2015 judgment. The Court directed the Reserve Bank of India (RBI) to disclose financial information regarding banks.

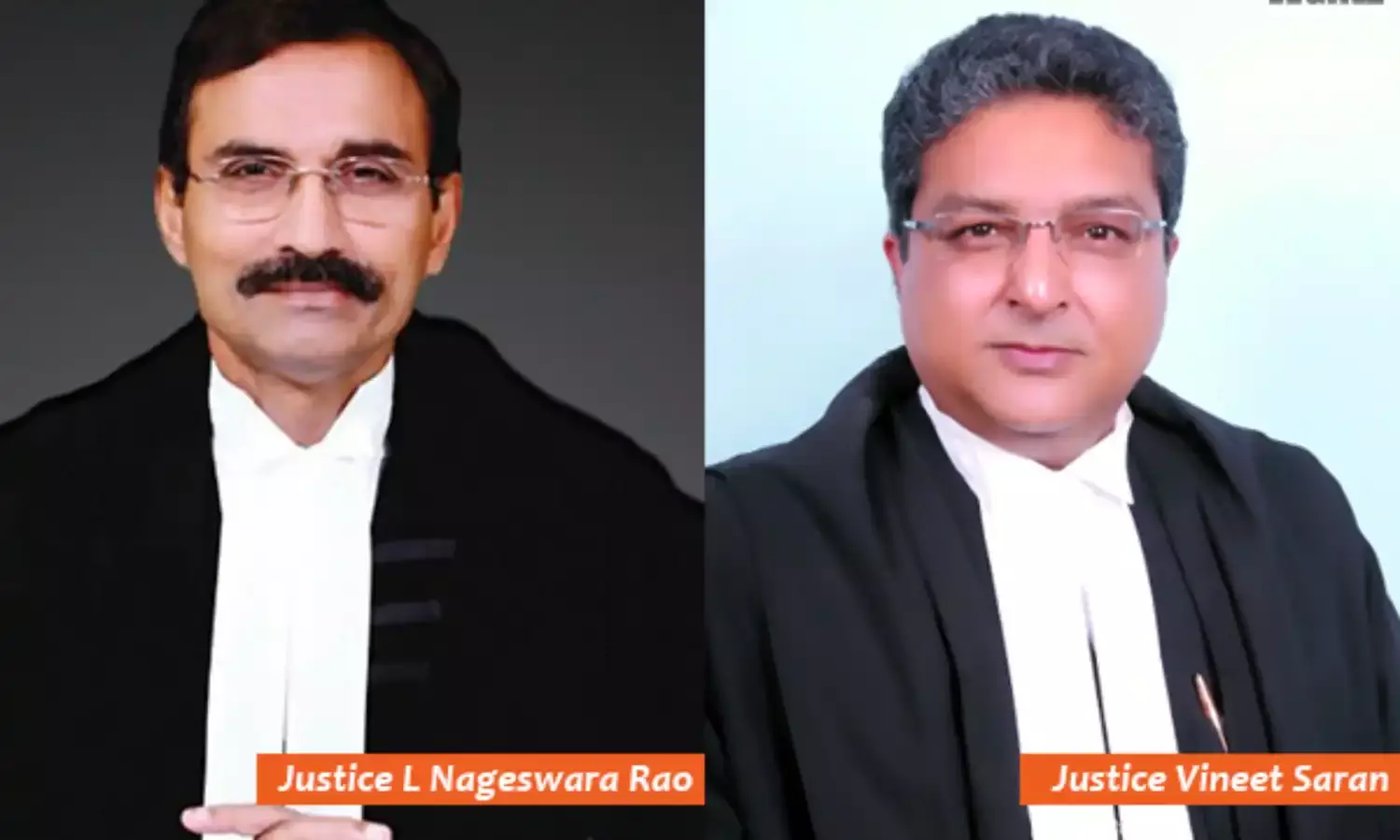

The SC bench comprising of Justices L Nageswara Rao and Vineet Saran while rejecting the application ruled that the applications for recall were not maintainable and were an attempt to seek reconsideration of the 2015 judgment.

In the instant matter, applications were filed by the Union Government, State Bank of India, Punjab National Bank, HDFC Bank, Bank of India, Canara Bank, Bank of Baroda, Uco Bank, Indian Bank, Kotak Mahindra and AU Small Finance Bank before the Top Court to recall its 2015 judgment.

In its 2015 verdict (Reserve Bank of India v. Jayantilal N. Mistry (2016) 3 SCC 525), the SC held that RBI was not in any fiduciary relationship with any bank. RBI has no legal duty to maximize the benefit of any public sector or private sector bank, and thus there is no relationship of 'trust' between them. RBI has a statutory duty to uphold the interest of the public at large, the depositors, the country's economy, and the banking sector.

Subsequently, RBI came out with disclosure policies in 2016 and 2019 that sought to dilute the impact of the court verdict. But after the SC initiated contempt proceedings against RBI, the regulator rolled back the 2019 policy.

After six months, the HDFC Bank and SBI filed applications for recall of the 2015 judgment and a different bench issued an interim order, wherein it directed that "Inspection Reports/Risk Assessment Reports/Annual Financial Inspection Reports of the Banks including State Bank of India shall not be released by the Reserve Bank of India until further orders."

After the aforesaid order was passed more banks queued up for seeking the same relief and the banks urged that it is a violation of natural justice, as the banks were not heard when the 2015 judgment was passed.

The Central Government contended that disclosure of such information could hurt the economic interest of the country and not just the entities involved and therefore, it was imperative to recall the judgment and reconsider the issues afresh.

The contentions were opposed by stated that a review petition would require consideration of the matter on merits in case there is an error apparent on the face of the record. Whereas, recall applications are entertained only in case the judgment is passed without jurisdiction, or without an opportunity hearing being given to the affected party.

In Delhi Administration v. Gurdip Singh Uban & Ors., this Court made it clear that applications filed for clarification, modification or recall are often only a camouflage for review petitions. It was held that such applications should not be entertained, except in extraordinary circumstances.

The Apex Court to maintain financial transparency in the banking system revived its 2015 judgment wherein the Court has made it mandatory for the Reserve Bank of India (RBI) to disclose financial information regarding private and public banks under the Right to Information (RTI) Act.

The SC bench noted that the banks did not make any attempt to present their version when the main case was heard and held that close scrutiny of the applications for recall makes it clear that in substance, the applicants are seeking a review of the judgment in Jayantilal N Mistry (2015 judgment) and dismissed the same on the grounds of being meritless.

The Apex Court noted that the dispute relates to information to be provided by RBI under the Act. Though the information pertained to the banks, it was the decision of RBI which was in challenge and decided by this court. No effort was made by any of the applicants in the miscellaneous applications to get them impleaded when the transferred cases were being heard by this Court.

The SC dismissed the application and concluded that "We are of the considered opinion that these applications are not maintainable. We make it clear that we are not dealing with any of the submissions made on the correctness of the judgment of this Court in Jayantilal N. Mistry (supra)."