Delhi High Court: AO Must Form Prima Facie Opinion Before Rejecting Application For Nil TDS Under Section 197

The Delhi High Court has ruled that an assessing officer must form a prima facie opinion on an assessee’s taxability;

Delhi High Court: AO Must Form Prima Facie Opinion Before Rejecting Application For Nil TDS Under Section 197

The Delhi High Court has ruled that an assessing officer must form a prima facie opinion on an assessee’s taxability in India before rejecting an application under Section 197 of the Income Tax Act, 1961, for nil or lower Tax Deducted at Source (TDS).

Section 197(1) allows an assessee to apply for a certificate permitting a lower or nil deduction of tax if the assessing officer is satisfied that the total income justifies such relief.

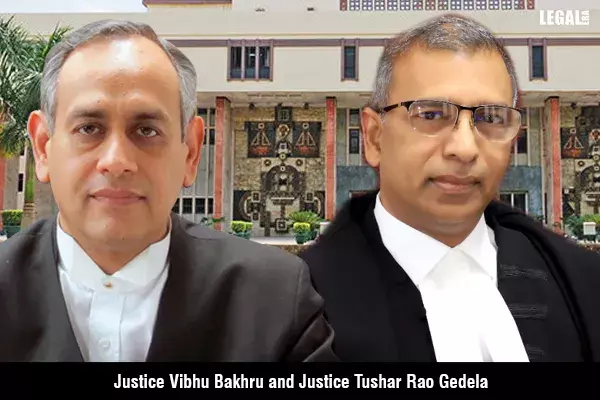

A division bench comprising Justices Vibhu Bakhru and Tushar Rao Gedela emphasized that the assessing officer is not required to make a final determination of taxability at this stage. However, they must assess whether a lower or nil withholding tax rate is justifiable based on the facts.

The petitioner, SFDC Ireland, challenged an order requiring it to receive payments from SFDC India only after deducting TDS at a rate of 2%. SFDC Ireland contended that its income from SFDC India was not taxable in India as it had no place of business, employees, or presence in the country. The company had merely appointed SFDC India as a non-exclusive reseller under a Reseller Agreement.

The assessing officer, however, argued that SFDC India constituted a Permanent Establishment (PE) of SFDC Ireland, citing clauses in the agreement that allegedly indicated dependency, such as SFDC India’s role in pricing decisions and contract execution.

The High Court examined Section 2.2 of the Reseller Agreement, which explicitly states that the parties operate on a principal-to-principal basis and remain independent contractors. It held that, in the absence of contrary evidence, SFDC India could not be deemed to bind SFDC Ireland or act on its behalf.

The court also rejected the claim that SFDC India played a role in price determination, stating that even if it provided input, this did not make it a dependent PE. Under Article 5(8) of the India-Ireland Double Taxation Avoidance Agreement (DTAA), an enterprise does not have a PE in India if its agent operates independently and in the normal course of business.

Furthermore, the court noted that for FY 2023-24, the petitioner’s application for nil TDS under Section 197 had been approved. The petitioner argued that the assessing officer failed to consider Rule 28AA of the Income Tax Rules, 1962, which requires past TDS history to be taken into account.

Agreeing with the petitioner, the court observed that the assessing officer had not made any prima facie finding that SFDC Ireland had a PE in India or that the payments were taxable under the Act. The order lacked sufficient grounds to support the rejection of the petitioner’s request.

Accordingly, the Delhi High Court set aside the impugned order and directed the assessing officer to issue a certificate under Section 197(1) allowing nil withholding tax.