- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

From General Counsel to Independent Director

From General Counsel to Independent Director

FROM GENERAL COUNSEL TO INDEPENDENT DIRECTOR GCs with their business experience, legal acumen and as guardians of ethical practice are apt candidates with the requisite knowledge and expertise, to be appointed on the Board of Directors In a recent study it has been observed that around 27% of General Counsels ("GCs") in Fortune 500 companies hold the position of executive vice...

To Read the Full Story, Subscribe to Legal Era News

Access Exclusive Legal Era Stories, Editorial Insights, and Expert Opinion.

Already a subscriber? Sign in Now

FROM GENERAL COUNSEL TO INDEPENDENT DIRECTOR

GCs with their business experience, legal acumen and as guardians of ethical practice are apt candidates with the requisite knowledge and expertise, to be appointed on the Board of Directors

In a recent study it has been observed that around 27% of General Counsels ("GCs") in Fortune 500 companies hold the position of executive vice president, while 26% hold the position of senior vice presidents. This reflects a new reality where the GC is being recognized as a strategic senior leader in the organization, with about 64% of GCs reporting in directly to the CEO. This trend is gaining momentum in India.

Today, a GC's role in a company is no-more just as in-house legal counsel, instead their role is much more complex and multi-dimensional. A GC is not only a legal expert, but also serves as a business partner to the CEO/CXO of a company and to its board of directors, both in listed and unlisted companies. An experienced GC contributes meaningfully to the company's important business decisions and strategy. The expansion of their role is reflected even more prominently in technology-based companies and in new start-ups where sound legal advice is critical in a still-developing legal landscape which is trying to keep up with non-conventional means of doing business. A GC's responsibility in this new landscape is even more crucial in ensuring that new-age companies understand and grow in compliance with the law.

A GC's role tends to go beyond the law and includes policy, compliance, corporate governance, risk and crisis management. GCs are not just expected to be well-versed with the current regulations but also be able to anticipate the regulatory changes which would impact the business' future vision. With the changing legal landscape in India, GCs are expected to be one step ahead of regulations as they are playing a solution-oriented role to solve for how their business and legal advice will be operationalized and also shaping the regulations for the future.

GCs, at times, also serve as the company secretary, who is a key managerial personnel under the Companies Act and as chief compliance officer. They are, by education and practice, also well-versed in corporate and securities laws. As a pivotal figure, the GC often acts as the "bridge" between the board of directors and the senior management in regulatory and strategic business decisions. The GC is often a special/permanent invitee to the board and audit committee meetings and well versed with its conduct and expectations, giving advice on both procedural and substantive matters. Their well-informed perspective is a huge asset for the organization bringing unique insights to board-room debates. Right from forming the agenda to reviewing resolutions and enabling "enterprise risk" evaluation for the organization, many directors rely on the GC to play an independent part and support them in meeting their fiduciary obligations.

GCs are also the watchdogs of ethics and good corporate governance. They are trusted with leading regulatory compliances for the company and these form the bedrock for the Board to provide disclosures and representations in the annual reports. The GC is often the watchdog of the company as Ethics Officer or directly or indirectly supervises the compliance network. They are groomed to ask the right question in the interest of the organization as well as the law, in letter and spirit by leveraging their resources.

With companies going global and governance principles influencing cross-borders, GCs in India are progressively involved in formulating company's overseas strategies working with their peers and other functional leaders in framing the thought process behind doing business internationally in addition to mapping legal requirements in the country. They act as guardians of the Company's assets and intellectual property. Their primary duty lies to the company and this enables well-thought outcomes keeping in mind interests of all stakeholders.

To comprehend a GC as a company director and/or as a company's CEO is no more a far-fetched thought, instead is a natural progression to their role. As natural partners to the promoters/shareholders, they are regarded as wise counselors. In addition, they are also actively sought-after by companies and investors, to be appointed independent director(s), whose role on the Board has become even more critical with ever increasing emphasis on corporate governance. Recent changes by the Securities and Exchange Board of India, the Ministry of Corporate Affairs and other regulatory and supervisory bodies demands a more professional, independent and transparent approach. Being naturally trained to be balanced and question the status quo and challenge management as required, lawyers have found a seat on the table and we witness many leading legal luminaries (both law firm partners and individual practitioners) on corporate boards. Several GCs being even better placed as they have unique in-house corporate business and legal experience, have expressed desire, post retirement or as their second career, to contribute through Board memberships.

To comprehend a GC as a company director and/or as a company's CEO is no more a far-fetched thought, instead is a natural progression to their role

GCs with their business experience, legal acumen and as guardians of ethical practice, are apt candidates with the requisite knowledge and expertise, to be appointed on the Board of Directors. The Ministry of Corporate Affairs has recognized this and in their recently amended Companies (Appointment and Qualification of Directors) Rules and exempted "an advocate of a court/chartered accountant in practice for 10 years" from taking the online proficiency self-assessment test for becoming independent directors. This exemption hopefully will soon be extended to GCs.

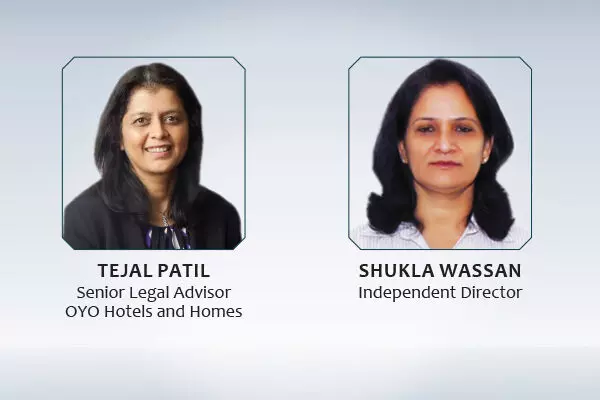

Says Shukla Wassan, Independent Director and co-author "Having worked for over 2 decades as General Counsel of various Indian companies and MNCs, I always aspired to transition as an Independent Director. This journey from GC to Independent Director has vindicated my belief that this is a wholesome evolution. As an Independent Director I have felt welcomed and valued. My perspectives are sought on all matters, which brings an opportunity for me to leverage my experience and contribute towards sustainable business growth of the company."

Disclaimer – The views expressed in this article are the personal views of the authors and are purely informative in nature.