- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

Suraj Sinha

From Suraj Sinha

Delhi High Court Rules In Favor Of IHCL; Bans Taj Iconic From Using Brand 'Taj'

It was found guilty of trademark infringement and defrauding a jeweler

Calcutta High Court: Allegations Of Fraudulent Signatures On Arbitration Agreements To Be Decided By Arbitrator, Not Court Under Section 11

Justice Sabyasachi Bhattacharyya of the Calcutta High Court has, recently ruled that allegations concerning a party’s

Bombay High Court Imposes ₹50 Lakh Penalty For Contempt In Fevicol Trademark Case

the Bombay High Court has imposed a substantial penalty of ₹50 lakhs on a company found in contempt for using a trademark

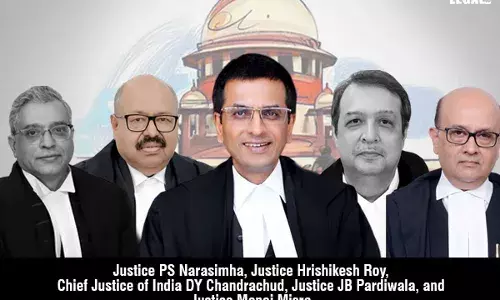

Supreme Court Constitution Bench Begins Hearing On Legality Of PSUs Appointing Arbitrators from Self-Curated Panels

On August 28, Constitution Bench of the Supreme Court began hearing a significant case on whether a person ineligible to

Calcutta High Court Rules ₹120 Court Fee Applicable For Section 34 Applications Challenging Arbitral Awards, Higher Fees Under Entry No. 1(10) Not Applicable

Justice Sabyasachi Bhattacharyya of the Calcutta High Court has determined that the principal application under Section

Delhi High Court: Arbitrator Can Deny Interest If Applicant Partially Responsible For Project Delays

Justice Prateek Jalan of the Delhi High Court, has affirmed the reasonableness of an arbitrator's decision to deny pre

CDSL And Citibank Settle Regulatory Violation Cases By Paying SEBI

They were accused of disregarding the operational framework for transactions in defaulted debt securities post-redemption

Delhi High Court Declares "Boroline" A Well-Known Trademark, Issues Injunction Against "Borobeauty"

The Delhi High Court has recognized “Boroline,” as a well-known trademark under the Trade Marks Act. Justice Mini Pushkarna

NCLT Hyderabad Approves Adani Power's ₹4,000 Cr Resolution Plan For Lanco Amarkantak Acquisition

NCLT Hyderabad approves Adani Power’s resolution plan for acquisition of Lanco Amarkantak for a total resolution amount

Calcutta High Court Rules Applications And Appeals Under Arbitration Act Can Be Heard By Commercial Division, Even If Filed On Original Side

Justice Sabyasachi Bhattacharyya of the Calcutta High Court has clarified the jurisdictional issues concerning applications

NCLAT: No New Settlement Proposals Permitted After Approval Of Resolution Plan

In a significant ruling, the National Company Law Appellate Tribunal (NCLAT) New Delhi division bench, comprising Justice

Zomato Bars AI-Generated Food Images After Surge In Customer Complaints

It has been receiving lower ratings and demands for refunds