- Home

- News

- Articles+

- Aerospace

- Agriculture

- Alternate Dispute Resolution

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- FDI

- Food and Beverage

- Health Care

- IBC Diaries

- Insurance Law

- Intellectual Property

- International Law

- Know the Law

- Labour Laws

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Technology Media and Telecom

- Tributes

- Zoom In

- Take On Board

- In Focus

- Law & Policy and Regulation

- IP & Tech Era

- Viewpoint

- Arbitration & Mediation

- Tax

- Student Corner

- AI

- ESG

- Gaming

- Inclusion & Diversity

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- News

- Articles

- Aerospace

- Agriculture

- Alternate Dispute Resolution

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- FDI

- Food and Beverage

- Health Care

- IBC Diaries

- Insurance Law

- Intellectual Property

- International Law

- Know the Law

- Labour Laws

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Technology Media and Telecom

- Tributes

- Zoom In

- Take On Board

- In Focus

- Law & Policy and Regulation

- IP & Tech Era

- Viewpoint

- Arbitration & Mediation

- Tax

- Student Corner

- AI

- ESG

- Gaming

- Inclusion & Diversity

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

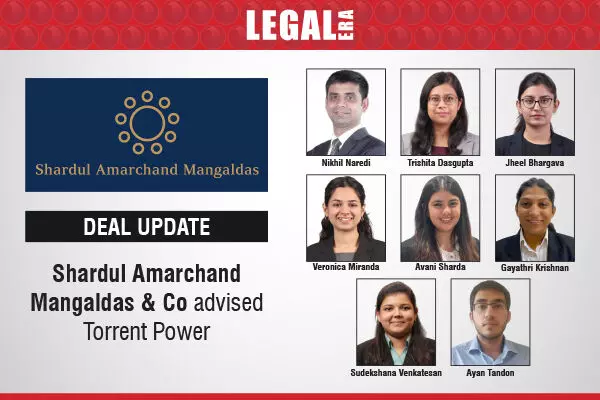

Shardul Amarchand Mangaldas & Co advised Torrent Power

Shardul Amarchand Mangaldas & Co advised Torrent Power

Shardul Amarchand Mangaldas & Co. advised Kotak Mahindra Capital Company Limited, Jefferies India Private Limited and JM Financial Limited, the book running lead managers on the QIP by Torrent Power Limited (“Torrent”) aggregating to INR 3,500.00 Crores (approximately USD 413.29 million).

Torrent is one of India’s leading private sector integrated power utility companies with an established presence across power generation, transmission, and distribution. Torrent’s QIP was launched and closed on December 2, 2024, and December 5, 2024, respectively.

The deal was concluded within an accelerated timeline due to high demand and lucrative market conditions for the investment. The firm had also advised the book running lead managers on the JSW Energy Limited’s QIP in April 2024.

The transaction team was led by Nikhil Naredi, Partner; Trishita Dasgupta, Counsel; Chinmay Sethia, Senior Associate; Jheel Bhargava, Associate; Manish Soni, Associate; Veronica Miranda, Associate; Avani Sharda, Associate; Gayathri Krishnan, Associate; and Charana Reddy, Associate; and Sudekshana Venkatesan, Associate from Infrastructure, Energy and Project Finance team assisted in infrastructure diligence and Ojaswi Shankar, Associate and Ayan Tandon, Associate from Dispute Resolution team helped out on the disputes related matters.

Click to Know more about Shardul Amarchand Mangaldas & Co.