- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

Nilima Pathak

From Nilima Pathak

Delhi High Court: DRT cannot entertain less than Rs.10 lakh claim under SARFAESI Act

The IDFC First Bank had challenged the rejection of its Section 13(10) application for lack of pecuniary jurisdiction

Delhi High Court: ITR Filing Date Relevant For Calculating Section 143(2) Limitation

Stresses that the notice cannot be served on the assessee after the expiry of six months

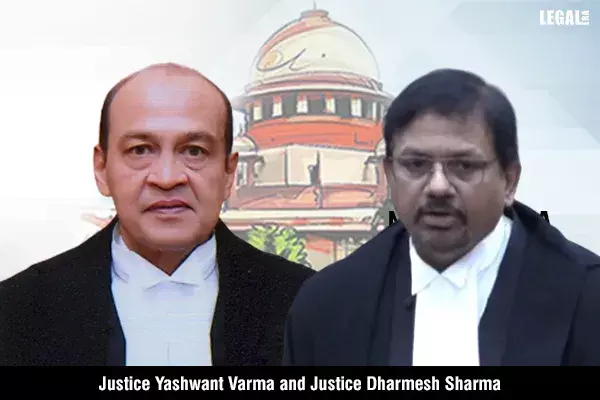

Arbitral Tribunal Orders West Bengal Government to Pay Tata Motors Rs.766 Crores For Scrapping Nano Car Project in Singur

In 2008, the company was forced to abandon the construction of its factory and shifted to Gujarat

Delhi High Court Reiterates Designation Of Venue Equivalent To Seat Of Arbitration In Absence Of Contrary Indicia

The respondent had objected to the maintainability of the petition based on the court’s lack of territorial jurisdiction

Petitioner Not To Be Deprived Of Benefit Due To Non-Constitution Of Appellate Tribunal By State: Patna High Court

Statutory remedy was sought against the impugned order under Section 112 of the Bihar GST

Delhi High Court: Competent Court To Examine IPR Valuation Suit Below Rs. 3 Lakh

Stresses that transfer to commercial court is not essential

Justice Nani Tagia and Justice Gunnu Anupama Chakravarthy Sworn In As Judges of Patna High Court

The oath of office was administered by Bihar Governor Rajendra Arlekar

Justice H.S Thangkhiew Appointed Acting Chief Justice of Meghalaya High Court

He resumed the position after the retirement of Chief Justice Sanjib Banerjee

Supreme Court: Insurance company cannot forego compensation in accident by employed driver if vehicle owner did not verify his licence

The Supreme Court has held that an insurance company cannot claim that it is not liable to pay compensation in a motor vehicle

In FERA, penalty on recovery gives rise to ‘enforceable debt' under Presidency Town Insolvency Act: Madras High Court

The Madras High Court has observed that the term 'decree' or 'order' used in the Presidency-Town Insolvency Act, 1909

Jharkhand High Court emphasizes IT department duty-bound to provide all information to assessee on assessment order

The Jharkhand High Court has held that under Section 148A of the Income Tax Act, 1961, the department is duty-bound and

Madras High Court directs Customs authority to release New Zealand imported apples on securing bank guarantee towards differential duty

The Madras High Court has directed the Department of Customs to release fresh apples imported from New Zealand on the furnishing