- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

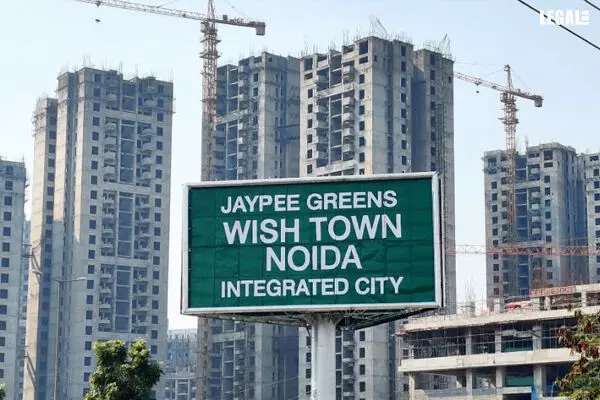

NCLAT Set to Review NCLT decision on YEIDA’s claims in Jaypee Infratech Case

NCLAT Set to Review NCLT decision on YEIDA’s claims in Jaypee Infratech Case

The National Company Law Appellate Tribunal (NCLAT), Delhi is set to hear the plea moved by Yamuna Expressway Industrial Development Authority (YEIDA), which has challenged the National Company Law Tribunal’s (NCLT) order dated 7 March, by which it had approved Suraksha Group's bid to acquire debt-ridden Jaypee Infratech.

However, the NCLAT has declined to stay the order passed by the NCLT on March 7, 2023.

“We make it clear that pendency of this appeal and the above interim order may not be treated as any restraint in implementation of the plan insofar as other aspects of the plan are concerned,” it said

Justice Ashok Bhushan (Chairman), by noting the substantial grounds was of the view that the appeal filed by YEIDA on NCLT judgment requires an early decision.

The NCLAT has found ‘substantial merit’ to entertain and hear the appeal as NCLT’s order virtually extinguishes YEIDA’s claim of additional compensation farmer’s compensation by allocating Rs. 10 lakhs.

“NCLT’s order has virtually extinguished the claim of the appellant (YEIDA) of additional farmers compensation by allocating an amount of Rs 10 lakh, which according to the respondents (Suraksha group and monitoring committee) is the amount to which the appellant is entitled and the said judgment under challenge in this appeal, we have found substantial ground to entertain this appeal and hear the appeal,” the bench stated.

Following which, the NCLAT proceeded to issue notices to the Suraksha Group as well as the monitoring panel constituted to implement the resolution plan on YEIDA’s petition.

In the meantime, NCLAT also directed that NCLT’s order shall not be relied in determination of rights and liabilities of the appellant and the corporate debtor in the pending proceedings in arbitration pending before the Commercial Court.

In February 2003, YEIDA had entered into a concession agreement with Jaypee, and had filed claims for Rs 6,111.59 crores, mainly on account of pending works and External Development Charges (EDCs), unexecuted external development works and other future works.

Further it had sought for 64.7 per cent additional compensation payable to farmers, from whom it had acquired land.

Thereafter, YEIDA had raised a demand/claim of approximately Rs. 1,689 crores towards the additional compensation payable to the farmers.

Originally the NCLT had rejected the claims and had observed, “we find no illegality committed by the SRA/Suraksha by treating the claim of YEIDA as an operational debt and making a provision towards its payment in accordance with the provisions of IBC, 2016.”

The Corporate Insolvency Resolution Process (CIRP) against JIL started in August 2017 on an application moved by IDBI Bank-led consortium.

Additional Solicitor General (ASG) N Venkataraman, appearing for YEIDA, contended before the NCLAT that the land which it gave to Jaypee Infratech is on lease and the company owns only leasehold interest.

Therefore, he contended that the transfer and monetization of land can only be limited to the leasehold interest in the project land, and the ownership rights remain with YEIDA.

He further highlighted that land parcels were acquired by YEIDA from hundreds of farmers, and they are entitled to receive compensation before Suraksha uses them, failing which it would highly unfair to the farmers.