- Home

- News

- Articles+

- Aerospace

- Agriculture

- Alternate Dispute Resolution

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- FDI

- Food and Beverage

- Health Care

- IBC Diaries

- Insurance Law

- Intellectual Property

- International Law

- Know the Law

- Labour Laws

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Technology Media and Telecom

- Tributes

- Zoom In

- Take On Board

- In Focus

- Law & Policy and Regulation

- IP & Tech Era

- Viewpoint

- Arbitration & Mediation

- Tax

- Student Corner

- AI

- ESG

- Gaming

- Inclusion & Diversity

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- News

- Articles

- Aerospace

- Agriculture

- Alternate Dispute Resolution

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- FDI

- Food and Beverage

- Health Care

- IBC Diaries

- Insurance Law

- Intellectual Property

- International Law

- Know the Law

- Labour Laws

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Technology Media and Telecom

- Tributes

- Zoom In

- Take On Board

- In Focus

- Law & Policy and Regulation

- IP & Tech Era

- Viewpoint

- Arbitration & Mediation

- Tax

- Student Corner

- AI

- ESG

- Gaming

- Inclusion & Diversity

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

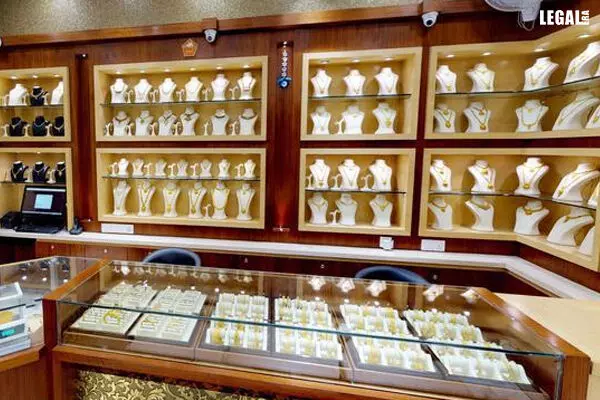

DGFT Grants Indian Jewellers Access to Bullion Exchange for Concessional Gold Imports from UAE

DGFT Grants Indian Jewellers Access to Bullion Exchange for Concessional Gold Imports from UAE

In a significant development for the Indian jewellery industry, the Director General of Foreign Trade (DGFT) has announced that authorised jewellers can now import gold from the United Arab Emirates (UAE) at a preferential customs duty through the India International Bullion Exchange (IIBX).

DGFT has revised the import policy for gold classified under HS Code 71081200 in Chapter 71 of Schedule I (Import Policy) of the Indian Trade Classification (HS) 2022.

The amended import policy stipulates that authorised India-UAE TRQ holders, as identified by the International Financial Services Centres Authority (IFSCA), are allowed to import gold through the India International Bullion Exchange within the allotted tariff-rate quota. The physical delivery of the imported gold can be obtained through IFSCA-registered vaults located in Special Economic Zones (SEZs), adhering to the guidelines set forth by IFSCA.

"This is a major step forward for the Indian jewellery industry," said Alok Vardhan Chaturvedi, DGFT. "The IIBX is a world-class bullion exchange that will provide jewellers with a transparent and efficient platform for gold imports. This will help to reduce costs and improve the competitiveness of the Indian jewellery sector."

The India International Bullion Exchange (IIBX) is a recently established bullion exchange that is poised to revolutionize gold imports and exports in India. The exchange is envisioned to play a pivotal role in transforming India into a global gold trading hub.

"Valid India UAE TRQ holders as notified by IFSCA can import gold through IIBX against the TRQ and can obtain physical delivery of the same through IFSCA-registered vaults located in SEZs as per the guidelines prescribed by the IFSCA," the DGFT said.

Under the current import policy framework, gold imports are only permitted through designated agencies authorised by the Reserve Bank of India (RBI) for banks, the Directorate General of Foreign Trade (DGFT) for other entities, and the International Financial Services Centres Authority (IFSCA) for eligible jewellers through the India International Bullion Exchange (IIBX). Gold Dore, an intermediate form of gold, can be imported by refineries contingent upon obtaining an import license with an AU condition.

As per the revised import policy, authorised importers can now procure gold through designated agencies, including:

• Banks: Authorised banks can import gold through agencies notified by the Reserve Bank of India (RBI).

• Other Entities: Non-bank entities can import gold through agencies nominated by the Directorate General of Foreign Trade (DGFT).

• Qualified Jewellers: Qualified jewellers, as identified by the International Financial Services Centres Authority (IFSCA), can import gold through the India International Bullion Exchange (IIBX).

Valid India-UAE TRQ holders, as recognised by the IFSCA, can utilise the IIBX to import gold within the allotted tariff-rate quota. The physical delivery of this imported gold can be acquired through IFSCA-registered vaults situated in Special Economic Zones (SEZs), adhering to the guidelines stipulated by IFSCA. Refineries can import Gold Dore upon obtaining an import license with an Actual User (AU) condition.

The DGFT's announcement has been welcomed by the Indian jewellery industry. The Gem and Jewellery Export Promotion Council (GJEPC) said that the move would boost gold imports and provide jewellers with a much-needed boost.