- Home

- News

- Articles+

- Aerospace

- AI

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- ESG

- FDI

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- News

- Articles

- Aerospace

- AI

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- ESG

- FDI

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

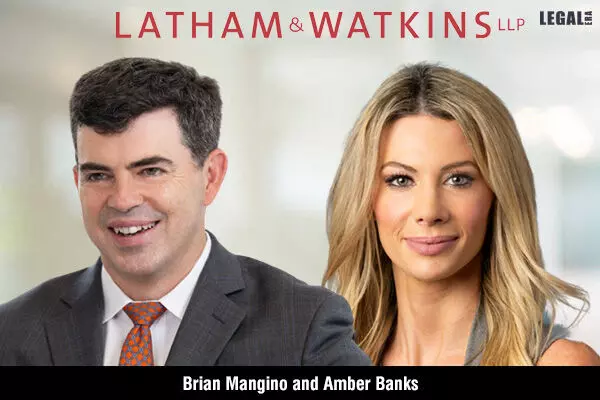

Latham & Watkins appoints Brian Mangino and Amber Banks as Partners in PE and M&A practices

Latham & Watkins appoints Brian Mangino and Amber Banks as Partners in PE and M&A practices

They were earlier serving at Fried, Frank, Harris, Shriver & Jacobson

Latham & Watkins LLP has announced that Brian Mangino and Amber Banks have joined the firm’s Washington, D.C., and New York offices, respectively.

Both partners bring substantial experience advising private equity firms and public and private companies on mergers and acquisitions and other complex corporate transactions.

Daniel Lennon, the Managing Partner of Latham & Watkins’ in Washington remarked, “Mangino is a nationally recognized private equity and M&A lawyer with one of the most significant practices in the market, and we are thrilled to welcome him to our Washington office. He has a premier reputation, strong technical skills, and deep client relationships, and will be instrumental in helping to expand Latham’s offerings both in the region and globally.”

Marc Jaffe, the Managing Partner of Latham & Watkins in New York commented, “Banks is a tremendous addition to our market-leading M&A and Private Equity practice in New York, and we are excited to welcome her to the firm. Her world-class transactional experience and drive strongly complement our long-term growth strategy in the New York office and across global platforms.”

Similarly, Charles Ruck, the Global Chair of the firm’s corporate department stated, “We are excited to welcome Mangino and Banks with significant experience leading the types of market-defining transactions complementary to Latham’s platform and client needs. We continue to see increased client demand for high-end transactional work. Expanding our bench with market-leading practitioners is a strategic priority of the firm. Their collective experience, outstanding commitments to client service, and team-oriented approach make them tremendous additions to our global platform and firm culture.”

Rich Trobman, the Chair and Managing Partner of the firm added, “We are strongly committed to the continuous expansion and investment in our global platform to stay ahead of clients’ needs in this increasingly complex and competitive environment. Mangino and Banks’ distinguished practices bring additional depth to our top-tier M&A and PE teams and underscore our goal to serve as a one-stop firm for helping clients navigate their comprehensive business objectives.”

On his appointment, Mangino stated, “I am thrilled to join Latham’s leading M&A and PE practice and look forward to contributing to the firm’s continued growth and success. The firm’s global platform and cross-disciplinary approach will benefit clients greatly as I apply the full range of services available to meet their business goals.”

Banks expressed, “Latham is an outstanding firm, known for its exceptional legal work and collaborative culture. I very much look forward to joining the team and working with colleagues across the firm’s global platform.”

Mangino and Banks were earlier serving at Fried, Frank, Harris, Shriver & Jacobson LLP.

Mangino received both his JD and undergraduate degree from the University of Virginia. He has advised on numerous high-profile M&A transactions, and his practice includes representing clients on corporate governance matters, defensive strategy, minority investments, strategic partnerships, spin-offs, joint ventures, securities law compliance, and general corporate matters.

Banks received her JD, cum laude, from Harvard Law School and her undergraduate degree from the University of San Diego. She represents major corporations and PE firms on sophisticated M&A and other complex corporate transactions, including joint ventures, growth equity investments, leveraged buyouts, and recapitalizations.