- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

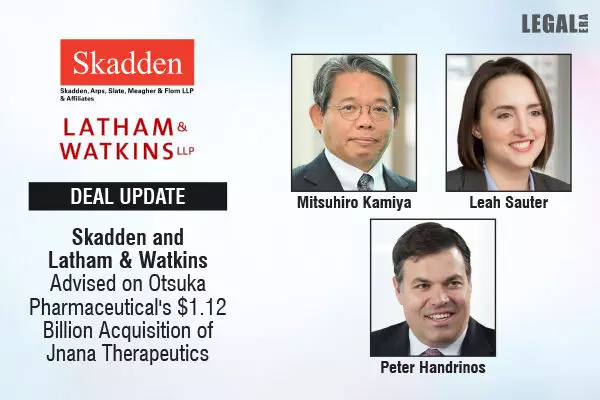

Skadden And Latham & Watkins Advised On Otsuka Pharmaceutical's $1.12 Billion Acquisition Of Jnana Therapeutics

Skadden And Latham & Watkins Advised On Otsuka Pharmaceutical's $1.12 Billion Acquisition Of Jnana Therapeutics

Otsuka Pharmaceutical acquired Boston-based biotechnology firm Jnana Therapeutics in a deal valued at up to USD1.12 billion. Skadden, Arps, Slate, Meagher & Flom represented Otsuka, while Latham & Watkins advised Jnana Therapeutics on the deal.

The acquisition, which is expected to close in the third quarter of 2024, involves an upfront payment of USD800 million to Jnana’s shareholders, with an additional USD325 million contingent on the achievement of specific development and regulatory milestones.

Skadden's legal team was led by Tokyo-based Partner Mitsuhiro Kamiya and Palo Alto-based Partner Mike Mies. The team also includes Partners Ken Kumayama, Joe Yaffe, David Schwartz, Nate Giesselman, Michael Leiter, Avia Dunn, Nesa Amamoo, and Peter Luneau.

Latham & Watkins' team advising Jnana was led by Partners Leah Sauter and Peter Handrinos, supported by Partners Matthew Conway, Katharine Moir, Aaron Gardner, Heather Deixler, Elizabeth Richards, and Patrick English.

Following the completion of the deal, Jnana Therapeutics will operate as a wholly-owned subsidiary of Otsuka through its indirect subsidiary, Otsuka America.