- Home

- News

- Articles+

- Aerospace

- AI

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- ESG

- FDI

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- News

- Articles

- Aerospace

- AI

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- ESG

- FDI

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

Freshfields, Reed Smith, And Kirkland & Ellis Advised On Henlius's $691M Take-Private Deal

Freshfields, Reed Smith, And Kirkland & Ellis Advised On Henlius's $691M Take-Private Deal

Freshfields Bruckhaus Deringer is acting as Legal Counsel for Hong Kong-listed biotech company Henlius in its $691 million take-private deal proposed by Shanghai Fosun New Medicine Research Company, which is receiving legal advice from Reed Smith.

Kirkland & Ellis provided legal counsel to the financial advisor, China International Capital Corporation (CICC), in this transaction.

Henlius, founded in 2010 and listed on the Hong Kong Stock Exchange in September 2019, specializes in a diverse product portfolio that includes treatments for oncology, autoimmune diseases, and ophthalmic diseases. The biotech firm has successfully launched five products in China and has three products approved for international markets. Significantly, Henlius reported its first annual profit in 2023.

Freshfields Bruckhaus Deringer is representing Henlius through this complex transaction, leveraging its expertise in advising on significant M&A deals.

Shanghai Fosun New Medicine Research Company, receiving guidance from Reed Smith, is orchestrating the take-private move.

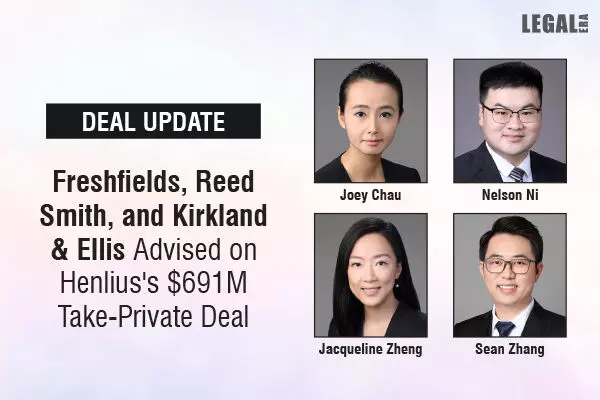

The financial advisor, CICC, is receiving legal counsel from a Kirkland & Ellis team led by Corporate Partners Joey Chau and Nelson Ni, with additional support from Debt Finance Partners Jacqueline Zheng and Sean Zhang.