- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

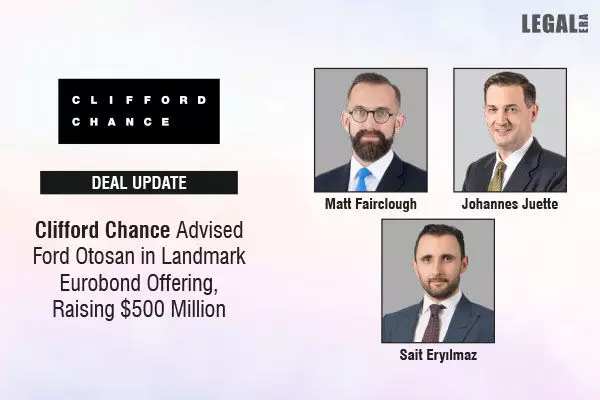

Clifford Chance Advised Ford Otosan In Landmark Eurobond Offering, Raising $500 Million

Clifford Chance Advised Ford Otosan In Landmark Eurobond Offering, Raising $500 Million

Global Law Firm Clifford Chance has provided Legal Counsel to Ford Otosan on its successful 144A/RegS Eurobond offering, which raised up to USD 500 million. The debut Eurobond offering, set to mature in 2029, garnered Robust Market Interest, Marking a significant milestone for Ford Otosan and solidifying its position as a key player in the Turkish corporate landscape.

Ford Otosan, a leading vehicle manufacturer Jointly Owned by Ford Motor Corporation and the Turkish conglomerate Koç Holding, stands among the top three exporting companies in Turkey.

The issuance was managed by Bookrunners BNP Paribas, Citi, HSBC, and Societe Generale, reflecting the confidence of investors in Ford Otosan's financial standing and growth prospects.

Clifford Chance's cross-border team, based in London and Istanbul, was led by partners Matt Fairclough, Johannes Juette, and Sait Eryilmaz. The partners received valuable support from Senior Associates Jake DuCharme, Jeffery Hung, and Ali Can Altıparmak, along with Bilgesu Çakmak (Associate) and Trey Oxendine (Law Clerk).