- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

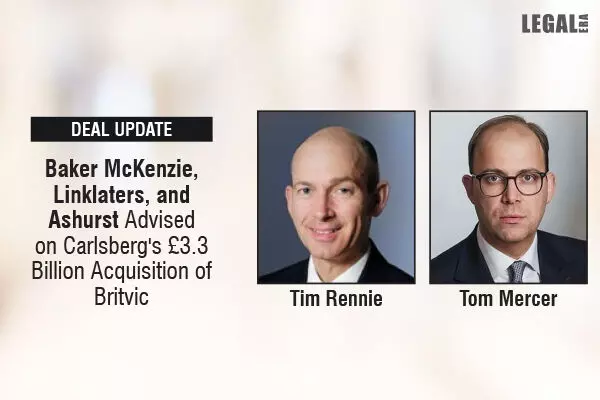

Baker McKenzie, Linklaters, And Ashurst Advised On Carlsberg's £3.3 Billion Acquisition Of Britvic

Baker McKenzie, Linklaters, And Ashurst Advised On Carlsberg's £3.3 Billion Acquisition Of Britvic

Baker McKenzie advised Carlsberg in its £3.3 billion acquisition of British soft drinks maker Britvic, which was represented by Linklaters.

This strategic move by Carlsberg came at a time when drinkers in certain markets were switching from beer to spirits or reducing their alcohol consumption. The acquisition enabled Carlsberg to expand its presence beyond the beer market and combine two major bottlers of PepsiCo's soft drinks.

Carlsberg secured the deal with an offer of 1,315 pence per share, comprised of cash and a special dividend of 25 pence per share, after Britvic had rejected two lower offers from the brewer.

The Baker McKenzie team advising Carlsberg was led by London corporate partner Nick Bryans and included partner James Thompson (corporate), Ben Wilkinson (banking and finance), Steve Holmes (commercial), Carl Richards (employment and benefits), Jonathan Sharp (pensions), and Natalie Ellerby (IP).

Last year, Bryans also led the Baker McKenzie team that advised Carlsberg on the sale of its Russian subsidiary, Baltika Breweries. This sale was derailed when the Kremlin took over the management of Baltika Breweries, prompting Carlsberg Group CEO Jacob Aarup-Andersen to claim that their business had been "stolen." Carlsberg announced last October that it had terminated its business in Russia and was engaged in a licensing dispute with Baltika.

The Linklaters team acting for Britvic was led by corporate partners Iain Fenn and Jonathan Sadler, along with managing associate Meila Burgess and global head of employment and incentives Alexandra Beidas. Linklaters had advised Britvic for over a decade on various matters, including a share buyback program and the renegotiation of a £300 million banking facility.

In a statement to the stock exchange, Carlsberg announced that Britvic's board had unanimously recommended the deal, which would create a new, enlarged group named Carlsberg Britvic.

Britvic had 39 brands across 100 countries, including J20 and Robinsons. It also held an exclusive license with PepsiCo in the UK and Ireland to produce and sell Pepsi Max, 7UP, Lipton Ice Tea, and Rockstar Energy. The deal had the support of PepsiCo and was set to make Carlsberg Britvic the largest PepsiCo bottling partner in Europe. Aarup-Andersen stated that the merger would combine Britvic's soft drinks portfolio with Carlsberg's strong beer portfolio and distribution capabilities, creating an "enhanced proposition" across the UK and Western European markets.

“We are committed to accelerating commercial and supply chain investments in Britvic, and we are confident that Carlsberg Britvic will become the preferred multi-beverage supplier to customers in the UK with a comprehensive portfolio of market-leading brands,” he added.

Carlsberg said the deal would enhance its top- and bottom-line growth profile in Western Europe and significantly increase cash flow in the region. The brewer expected the deal to create annual cost savings of around £100 million over five years through efficiencies in overheads, procurement, and supply chain operations.

The deal required approval from 75% of Britvic investors in a shareholder vote expected to take place in the coming months.

Nomura acted as the sole financial advisor to Carlsberg, with an Ashurst team led by partners Tim Rennie (banking) and Tom Mercer (corporate) advising Nomura.

Morgan Stanley acted as financial advisor to Britvic.