- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

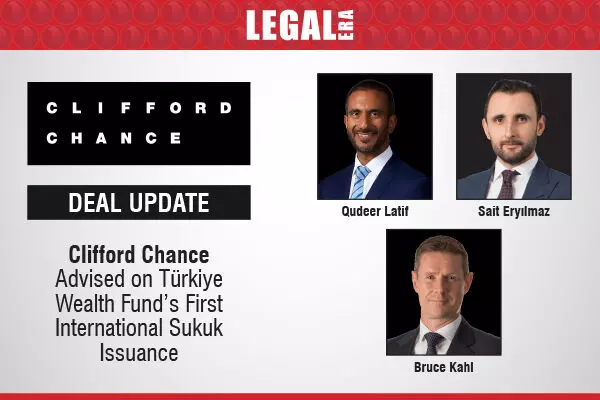

Clifford Chance Advised On Türkiye Wealth Fund’s First International Sukuk Issuance

Clifford Chance Advised on Türkiye Wealth Fund’s First International Sukuk Issuance

Global law firm Clifford Chance has advised the Joint Global Coordinators and Joint Bookrunners on the debut international sukuk issuance by TVF Varlık Kiralama A.Ş., with Türkiye Varlık Fonu (Türkiye Sovereign Wealth Fund or TWF) acting as Guarantor and TVF İFM Gayrimenkul İnşaat ve Yönetim A.Ş. (TWF IFC) as Obligor. TWF, Türkiye’s sovereign wealth fund, oversees the Istanbul Financial Center through TWF IFC, its wholly-owned subsidiary. The Issuer, an asset leasing company established by TWF under Turkish law, was specifically created for this sukuk issuance.

The 5-plus year sukuk was priced at a 6.95% profit rate and was met with robust demand, being over four times oversubscribed (excluding Joint Bookrunners’ interest) and attracting a diverse group of local, regional, and international investors.

The Clifford Chance team advising Toho was led by Partner and Global Head of Islamic Finance Qudeer Latif (Dubai), supported by Partners Stuart Ure (Dubai) and Sait Eryılmaz (Istanbul), Senior Associate Nader Koudsi (Dubai), Legal Consultant Shauaib Mirza (Dubai), Senior Associate Ali Can Altıparmak (Istanbul), Associate Bilgesu Cakmak (Istanbul), and Trainees Hafsah Akhtar (Dubai) and Aykan Karpuzcu (Istanbul). Partner Bruce Kahl led the team advising BNY Mellon Corporate Trustee Services Limited, supported by Senior Associate Struan Murray and Associate Micah McDonald in London.

The Global Coordinators comprised Emirates NBD Capital, J.P. Morgan, and Standard Chartered Bank, while the Joint Bookrunners included institutions such as Bank ABC, BBVA, BofA Securities, Dubai Islamic Bank, First Abu Dhabi Bank, ING, KFH Capital, Sharjah Islamic Bank, Société Générale, and Standard Chartered Bank.

Commenting on the transaction, Clifford Chance Partner Qudeer Latif said, “We are delighted to have supported TWF in connection with its successful debut international sukuk issuance. This is a testament to both TWF and the growing maturity of the Turkish sukuk market as this is the first USD sukuk to have been issued outside of the Sovereign and Participation Bank sector in Türkiye.”

Click to know more about Clifford Chance