- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

Amendments In GST Laws From October 1 For ONLINE GAMING Genesis And Implications

Amendments In GST Laws From October 1 For ONLINE GAMING Genesis And Implications

Amendments In GST Laws From October 1 For ONLINE GAMING Genesis And Implications The GST amendments envisage a confiscatory tax regime on online gaming and may significantly reduce the user base of online gaming companies, forcing many to exit the market and leading to consolidation in this space For the past couple of years, the ‘online gaming’ sector has been under the scrutiny of...

To Read the Full Story, Subscribe to Legal Era News

Access Exclusive Legal Era Stories, Editorial Insights, and Expert Opinion.

Already a subscriber? Sign in Now

Amendments In GST Laws From October 1 For ONLINE GAMING Genesis And Implications

The GST amendments envisage a confiscatory tax regime on online gaming and may significantly reduce the user base of online gaming companies, forcing many to exit the market and leading to consolidation in this space

For the past couple of years, the ‘online gaming’ sector has been under the scrutiny of the Goods and Services Tax (GST) department and perceived as a potential revenue generating sector. In this article, the authors discuss the impact of the substantive amendments that have been made to the Central Goods and Services Tax Act, 2017 (CGST Act) and Central Goods and Services Tax Rules, 2017 (CGST Rules) as well as the Integrated Goods and Services Tax Act, 2017 (IGST Act) to specifically tax the ‘online real money gaming’ sector.

Key events necessitating amendments to the GST laws

The GST department commenced investigations against the companies engaged in the ‘online gaming’ sector in the latter half of 2021. These companies were uniformly depositing GST at the rate of 18 % on the charges being collected by them in lieu of providing the online players and users access to their gaming platform or mobile gaming application.

The GST department, on the contrary, alleged that the companies engaged in ‘online gaming’ were not merely engaged in providing access to their gaming platform and mobile application. Instead, they are engaged in supplying ‘actionable claim’ to the online players in the form of chance to win in ‘betting and gambling’.

On the foregoing basis, the GST department started issuing show cause notices to online gaming companies - one of the largest was issued to Gameskraft Technologies Private Limited (GTPL), demanding GST to the tune of INR 21,000 crores, along with interest and penalty.

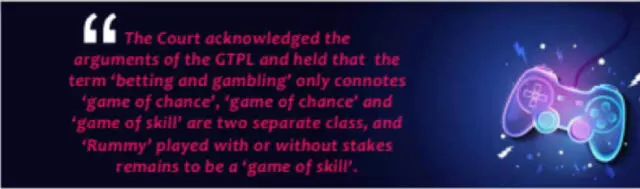

GTPL challenged the show cause notice before the Hon’ble Karnataka High Court, which had quashed and set it aside. The Court acknowledged the arguments of the GTPL and held that the term ‘betting and gambling’ only connotes ‘game of chance’, ‘game of chance’ and ‘game of skill’ are two separate class, and ‘Rummy’ played with or without stakes remains to be a ‘game of skill’. In addition, it was also argued that gaming companies such as GTPL are online intermediaries and only provide facilitation services and are not engaged in supply of ‘actionable claim’.

The Court quashed the said show cause notice and the INR 21,000 crore GST demand in a detailed order. This has now been appealed before the Supreme Court.

In the foregoing context, to dilute the arguments that have been upheld by the High Court, amendments have been made to the CGST Act and the CGST Rules.

Key amendments in the CGST Act and the CGST Rules

Some of the key amendments made in the CGST Act and the CGST Rules are as follows. Amendments have also been made in the IGST Act vis a vis gaming platforms located outside India which have not been dealt with in this article.

Amendments to the CGST Act |

Inserted a new Section 2(80A) – This provision defines ‘online gaming’ to mean offering a game over internet or electronic network. |

Inserted a new Section 2(80B) –This provision defines ‘online money gaming’ to mean a game in which a player deposits money or money’s worth including virtual digital assets in the expectation of winning money or money’s worth including virtual digital assets, irrespective of whether the outcome is dependent on chance or skill or both. |

Inserted a new Section 2(102A) – This provision defines the term ‘specified actionable claim’ to include actionable claims involved in online money gaming. |

Inserted a proviso in the definition of the term “supplier” in Section 2(105) – This provision deems the online gaming company to be the ‘supplier’ of specified actionable claim involved in online gaming. |

Amendment of Entry 6 of Schedule III of the CGST Act – This provision has been amended to state that ‘actionable claims’ are outside the scope of GST laws with the exception being that of ‘specified actionable claims’. |

Amendments to the CGST Rules |

Inserted a Rule 31B – This is a new provision which provides for the valuation mechanism of online gaming and provides that valuation shall be done based on the amounts deposited with the supplier (online gaming company) by or on behalf of the player. Further, any amount returned to the player is not deductible. Explanation to Rule 31B, however, provides that in case the winning amount is redeployed for a fresh gameplay then, such redeployment shall not be treated as a fresh deposit. |

The foregoing overview depicts sweeping amendments made in the framework to tax the online gaming sector.

Impact of the amendments

It appears that the settled distinction of several decades between ‘game of chance’ and ‘game of skill’ is sought to be done away with. Whether such amendments vitiate the legal principles evolved in various cases starting from the judgment in the case of RMD Chamarbaugwala v Union of India[AIR 1957 SC 699]may be tested in the coming days.

The fact that deeming provision in the definition of ‘supplier’ has been incorporated depicts that for the earlier periods, the online gaming companies were not a supplier of ‘actionable claim’. Therefore, the demands raised for the earlier period ought to automatically fall, more so since the amendments do not seem to have been given a retrospective effect. Another perspective which may require examination in the coming days is the scope and ambit of a ‘deeming’ fiction. The question as to whether a deeming fiction can operate to such an extent that an assessee is saddled with a liability of an amount which it never receives in the first place may need further clarification.

Rule 31B treats every amount deposited with the online gaming company as the basis for valuation of the supply, notwithstanding the fact that the amounts are not retained by the online gaming company. On the face of it, the very purport of the provision seems to be contrary to the well-understood concept of ‘consideration’ under law.

Rule 31B treats every amount deposited with the online gaming company as the basis for valuation of the supply, notwithstanding the fact that the amounts are not retained by the online gaming company

These amendments have been notified to come into effect from 1 October 2023 even though many of the States are yet to pass their corresponding amendments in their respective State GST statutes. This goes against the very fundamental premise of GST – ‘one nation one tax’ through simultaneous power of taxation with the Centre and the States which neither can unilaterally exercise (as per the Supreme Court) – this aspect may be vulnerable to a constitutional challenge soon.

Conclusion

The GST amendments envisage a confiscatory tax regime on online gaming and may significantly reduce the user base of online gaming companies, forcing many to exit the market. This may further lead to job losses and funding freeze as well as consolidation in this space. Given the nature of these amendments, they may also be vulnerable to constitutional challenges before a court of law.

Disclaimer – The views expressed in this article are the personal views of the authors and are purely informative in nature.