- Home

- News

- Articles+

- Aerospace

- AI

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- ESG

- FDI

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- News

- Articles

- Aerospace

- AI

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- ESG

- FDI

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

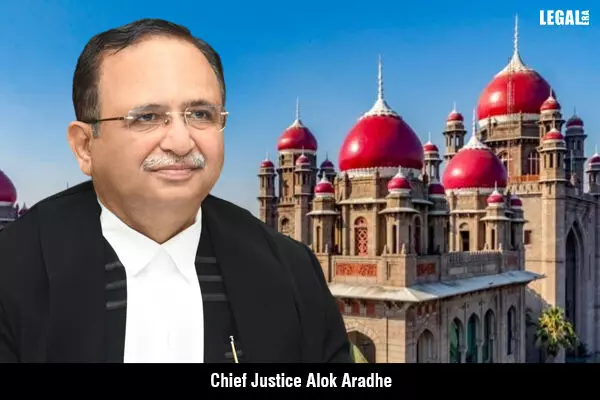

Telangana High Court: Under A&C Act, Section 9 IBC Petition Cannot Bar Section 11(6) Arbitration

Telangana High Court: Under A&C Act, Section 9 IBC Petition Cannot Bar Section 11(6) Arbitration

Appoints Justice P. Naveen Rao, former Acting Chief Justice, as the sole arbitrator

The Telangana High Court has held that the mere filing of a petition under Section 9 of the Insolvency and Bankruptcy Code (IBC), 1996, before the National Company Law Tribunal (NCLT) does not bar initiation of proceedings under Section 11(6).

The bench of Chief Justice Alok Aradhe added that no statutory provision barred a party from initiating proceedings under Section 11.

Section 9 of the IBC deals with the application for initiation of the Corporate Insolvency Resolution Process (CIRP) by an operational creditor. Whereas Section 11 allows parties to agree on appointing an arbitrator or arbitrators. If the parties do not agree on the procedure, Section 11 provides the court to appoint an arbitrator.

Valmar Projects LLP (applicant) and Isthara Parks Pvt Ltd (respondent) entered a Facilities Service Agreement (FSA) and a Catering Service Agreement (CSA).

Under CSA, the respondent had to supply food to the inmates of the applicant's hostel. Under the FSA, it was to provide housekeeping services.

A dispute arose between the parties, which led to the termination of the agreements.

Thereafter, the respondent issued a notice under Section 8 of the IBC, to which the applicant responded.

Subsequently, the respondent filed a petition under Section 9 of the IBC before the Hyderabad bench of the NCLT.

The NCLT directed the issuance of notice to the applicant. On receiving the notice, the applicant issued a notice under the Arbitration and Conciliation Act, (A&C), 1996. It approached the high court to appoint an arbitrator.

The applicant submitted that the respondent did not deny the existence of the arbitration agreement and the disputes between the parties. It added that the agreement envisaged the reference of disputes to a sole arbitrator. Despite the ongoing NCLT proceedings, the court could address the arbitration applications on merits, as there was no statutory bar.

However, the respondent argued that the applicant filed the application for appointing an arbitrator as a countermeasure to the former's proceedings before the tribunal. It was initiated with ulterior motives.

Chief Justice Aradhe referred to Section 21 of the A&C Act, noting that unless agreed upon by the parties, the arbitral proceedings concerning a specific dispute began on the date the respondent received the request.

He cited the decision of the Supreme Court in the State of Goa vs. Praveen Enterprises case, wherein it was clarified that Section 21 mandated a party to outline the disputes in the notice but did not require the quantification of the amount in dispute. It meant that the absence of a specified amount in the notice did not invalidate the claim or bar it from arbitration.

The bench also referred to the top court’s decision in the Indus Biotech Pvt Ltd vs. Kotak India Venture (Offshore) Fund case, wherein it was held that merely filing an application under Section 7 of the IBC (not yet admitted), did not constitute a proceeding in rem. Thus, it did not prevent the invocation of arbitration.

The court observed that the respondent initiated the proceedings under Section 9, which were pending before the NCLT. However, it did not preclude the commencement of arbitration proceedings under Section 11(6). Since no order was passed in the Section 9 proceedings, these were maintainable.

Thus, to adjudicate the dispute, the bench appointed Justice P. Naveen Rao, former Acting Chief Justice, as the sole arbitrator