- Home

- News

- Articles+

- Aerospace

- Agriculture

- Alternate Dispute Resolution

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- FDI

- Food and Beverage

- Health Care

- IBC Diaries

- Insurance Law

- Intellectual Property

- International Law

- Know the Law

- Labour Laws

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Technology Media and Telecom

- Tributes

- Zoom In

- Take On Board

- In Focus

- Law & Policy and Regulation

- IP & Tech Era

- Viewpoint

- Arbitration & Mediation

- Tax

- Student Corner

- AI

- ESG

- Gaming

- Inclusion & Diversity

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- News

- Articles

- Aerospace

- Agriculture

- Alternate Dispute Resolution

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- FDI

- Food and Beverage

- Health Care

- IBC Diaries

- Insurance Law

- Intellectual Property

- International Law

- Know the Law

- Labour Laws

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Technology Media and Telecom

- Tributes

- Zoom In

- Take On Board

- In Focus

- Law & Policy and Regulation

- IP & Tech Era

- Viewpoint

- Arbitration & Mediation

- Tax

- Student Corner

- AI

- ESG

- Gaming

- Inclusion & Diversity

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

Supreme Court: Secured Asset recoveries under SARFAESI Act will prevail over recoveries under MSMED Act

Supreme Court: Secured Asset recoveries under SARFAESI Act will prevail over recoveries under MSMED Act

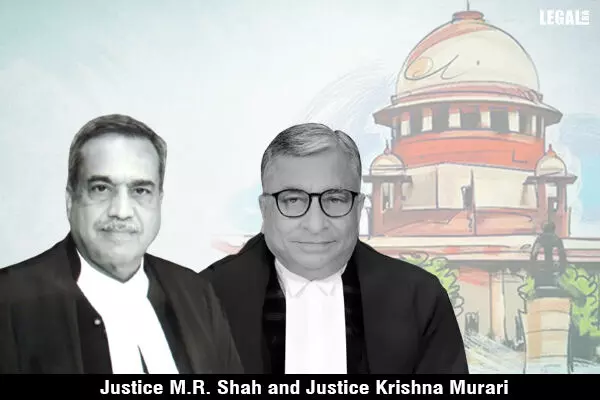

The Supreme Court by its division bench comprising of Justices M.R. Shah and Krishna Murari rejected the judgment passed by the Madhya Pradesh High Court and observed that dues under Micro, Small and Medium Enterprises Development Act, 2006 (in short MSMED Act) would not prevail over Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (in short SAFAESI Act).

The Kotak Mahindra Bank Limited- appellant/ secured creditor moved to the Apex Court for an appeal against the judgment passed by the Madhya Pradesh High Court. According to the High Court, under Section 24 of the MSMED Act, which provides that the provisions of Sections 15 to 23 of the MSMED Act would have an overriding effect and shall have effect notwithstanding anything inconsistent therewith contained in any other law for the time being in force and since the MSMED Act being a later enactment, then the SARFAESI Act, the MSMED Act would prevail over the SARFAESI Act.

The Top Court observed that the Sections 15 to 23 of the MSMED Act only provide special mechanism for adjudication of the dispute along with enforcing certain other contractual and business terms on the parties such as time limit for payments and interest in case of delayed payments. In the entire MSMED Act, there is no specific express provision giving 'priority' for payments under the MSMED Act over the dues of the secured creditors or over any taxes or cesses payable to Central Government or State Government or Local Authority.

Furthermore, the Court noted that, "in sharp contrast to this, Section 26E of the SARFAESI Act which has been inserted vide Amendment in 2016, provides that notwithstanding anything inconsistent therewith contained in any other law for the time being in force, after the registration of security interest, the debts due to any secured creditor shall be paid in 'priority' over all other debts and all revenue taxes and cesses and other rates payable to the Central Government or State Government or Local Authority."

However, the Court was of the view that the priority to secured creditors in payment of debt as per Section 26E of the SARFAESI Act shall be subject to the provisions of the IBC. Therefore, such dues vis-a-vis dues under the MSMED Act, as per the decree or order passed by the Facilitation Council debts due to the secured creditor shall have a priority in view of Section 26E of the SARFAESI Act which is later enactment in point of time than the MSMED Act. At this stage, it was required to be noted that Section 26E of the SARFAESI Act which was inserted in 2016 is also having a non-obstante clause.

The Apex Court was of the view that Sections 15 to 23 read with Section 24 of the MSMED Act and the provisions of the SARFAESI Act, no repugnancy exists between two enactments viz. SARFAESI Act and MSMED Act and that there is no conflict between two schemes, i.e., MSMED Act and SARFAESI Act as far as the specific subject of 'priority' is concerned.

It was highlighted by the Apex Court that the object and purpose of the enactment of SARFAESI Act is required to be considered. SARFAESI Act has been enacted to regulate securitization and reconstruction of financial assets and enforcement of security interest and to provide for a central debts of security interest created on property rights, and for matters connected therewith or incidental thereto. Therefore, SARFAESI Act has been enacted providing specific mechanism / provision for the financial assets and security interest. It is a special legislation for enforcement of security interest which is created in favor of the secured creditor – financial institution.

The Court concluded that if the motion forwarded by the Respondent- Grinar Corrugators Pvt Ltd and others were to be accepted then Section 26E of the SARFAESI Act would become nugatory and would become otiose and/or redundant. Any other contrary view would be defeating the provision of Section 26E of the SARFAESI Act and the object and purpose of the SARFAESI Act. In view of the above considerations the Court stated that the judgment and order passed by the Division Bench of the High Court was unsustainable and the same deserved to be quashed and set aside. Consequently, the present appeal was allowed.