- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

Supreme Court: Section 327(7) of Companies Act is Not Violative of Article 21

Supreme Court: Section 327(7) of Companies Act is Not Violative of Article 21

The Supreme Court in a landmark ruling has upheld the validity of provisions of the Companies Act that exclude statutory claims of workers' dues when a firm is undergoing the insolvency process.

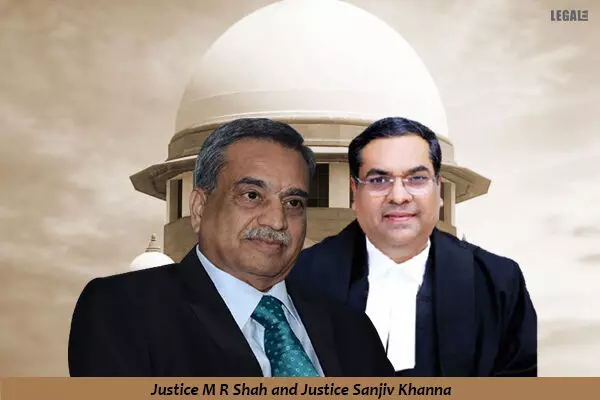

The division judges’ bench of Justices M.R. Shah and Sanjiv Khanna observed that Sections 326 and 327 of the Companies Act, 2013 shall not be applicable in the event of liquidation under the Insolvency and Bankruptcy Code, 2016 (in short IBC) and it applies with respect to the liquidation of a company under the IBC. The bench upheld that, Section 327(7) of the Act, 2013 cannot be said to be arbitrary and/or violative of Article 21 of the Constitution of India.

In the present case, Moser Baer Karamchari Union had approached the Court seeking declaration of Clause 19(a) of the Eleventh Schedule of the IBC pursuant Section 255 of the IBC, as violative of Article 14 of the Constitution, as Clause 19(a) of the Eleventh Schedule of the IBC inserts sub-section (7) in Section 327 of the Companies Act, 2013, which puts statutory bar on the application of Sections 326 and 327 of the Companies Act, 2013, to the liquidation proceedings under the IBC.

The Petitioners sought for declaration of sub-section (7) of Section 327 of the Companies Act, 2013, as violative of Article 14 of the Constitution, as sub-section (7) of Section 327 of the Companies Act, 2013, which was inserted in Section 327 of the Companies Act, 2013 pursuant to Section 255 and the Eleventh Schedule of the Insolvency and Bankruptcy Code, 2016, creates unreasonable classification for the distribution of legitimate dues of workmen in the event of liquidation of the Company under the IBC and liquidation of Company under the provisions of the Companies Act, 2013.

Further, the Petitioners had pleaded that distribution of the workmen's due as envisaged under Section 53(1)(b)(i) of the IBC, be declared as violative of Article 14 of the Constitution, as Section 53(1)(b)(i) of the IBC limits the workmen's dues payable to workmen to twenty-four months only preceding the date of order of Liquidation and then rank the said workmen's dues equally with the secured creditors in the events such secured creditors has relinquished security in the manner set out in Section 52 of the IBC.

The Apex Court noted that Sub-Section (7) of Section 327 of which the vires is under challenge, shall be applicable in case of liquidation of a company under the IBC.

The Apex Court highlighted that in case of liquidation of a company under IBC, the provisions of Section 53 of the IBC and other provisions of the IBC shall be applicable as the company is ordered to be liquidated or wound up under the provisions of IBC.

The Court observed, “merely because under the earlier regime and in case of winding up of a company under the Act, 1956/2013, the dues of the workmen may have pari passu with that of the secured creditor, the petitioner cannot claim the same benefit in case of winding up/liquidation of the company under IBC. The parties shall be governed by the provisions of the IBC in case of liquidation of a company under the provisions of the IBC.”

The Apex Court appositely stated that in the waterfall mechanism, after the costs of the insolvency resolution process and liquidation, secured creditors share the highest priority along with a defined period of dues of the workmen. The unpaid dues of the workmen are adequately and significantly protected in line with the objectives sought to be achieved by the Code and in terms of the waterfall mechanism prescribed by Section 53 of the Code.

On the issue of challenges made to legislation in economic matters, the Court asserted, “In a challenge to such legislation, the Court does not adopt a doctrinaire approach. Some sacrifices have to be always made for the greater good, and unless such sacrifices are prima facie apparent and ex facie harsh and unequitable as to classify as manifestly arbitrary, these would be interfered with by the court.”

Further the bench held that reasons and grounds for winding up under Section 271 of the Companies Act, 2013 are vastly different from the reasons and grounds for the revival and rehabilitation scheme as envisaged under IBC and they cannot be equated for examining whether there is discrimination or violation of Article 14 of the Constitution, observed, “Companies Act, 2013 does not deal with insolvency and bankruptcy when the companies are unable to pay their debts or the aspects relating to the revival and rehabilitation of the companies and their winding up if revival and rehabilitation is not possible. In principle, it cannot be doubted that the cases of revival or winding up of the company on the ground of insolvency and inability to pay debts are different from cases where companies are wound up under Section 271 of the Companies Act 2013.”

Lastly, the bench concluded that as per Section 36(4) of IBC, all sums due to any workman or employee from the provident fund, the pension fund, and the gratuity fund shall not be included in the liquidation estate assets and shall not be used for the recovery in the liquidation, and therefore, the same cannot be said to be arbitrary and violative of Article 21 of the Constitution of India as contended on behalf of the Petitioner.

Senior Advocate K.V. Viswanathan appeared as Amicus Curiae and Senior Advocate Gopal Sankaranarayanan appeared for the Petitioners. On the other hand, Additional Solicitor General (ASG) Balbir Singh appeared for the Respondent.