- Home

- News

- Articles+

- Aerospace

- AI

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- ESG

- FDI

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- News

- Articles

- Aerospace

- AI

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- ESG

- FDI

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

Supreme Court Rules On Prospective Application Of 2002 Amendment To Central Sales Tax Act

Supreme Court Rules On Prospective Application Of 2002 Amendment To Central Sales Tax Act

The Supreme Court has ruled that the amendment to Section 8(5) of the Central Sales Tax (CST) Act, which removed the State Government's power to grant tax exemptions, is prospective in nature. The Court clarified that the amendment would not affect cases where an exemption had already been granted before the law changed.

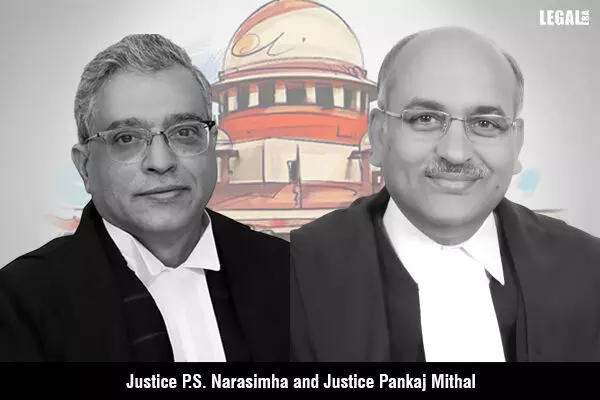

Justices P.S. Narasimha and Pankaj Mithal observed that the amended Act does not nullify rights that had already been granted, nor does it cancel or revoke previous exemptions. The ruling came in response to a case where the assessee/respondent contested three trade circulars issued by the Commissioner of Sales Tax, Mumbai, which sought to revise assessments and demand refunds of the tax exemptions granted under the Package Scheme of Incentives. The notices claimed the respondent had failed to submit required forms under Section 8(4) of the Act.

The respondent had been granted an exemption under the scheme by the State of Maharashtra, which was allowed under the provisions of Section 8(5) of the CST Act. However, the Finance Act of 2002 amended the law, limiting the State Government's authority to grant exemptions only if certain conditions, such as providing Form 'C' or 'D', were met.

The Court ruled that the 2002 amendment only applied prospectively and did not affect benefits already granted under the pre-amendment regime. The exemption granted to the respondent under the 1993 scheme remained valid. Citing previous cases, including Darshan Singh v. Ram Pal Singh and Anr., the Court emphasized the principle that laws are presumed to be prospective unless explicitly stated otherwise.

Furthermore, the Court highlighted that a substantive right, once accrued, cannot be revoked unilaterally without providing notice or an opportunity for hearing. In this case, the State Government could not have unilaterally taken away the respondent’s right to claim the tax exemption. The Court also pointed out that the respondent’s Eligibility Certificate had not been revoked, affirming that the granted benefit continued to stand.

As a result, the Supreme Court ruled that the State Government's attempt to revoke the exemption was unjustified. The requirement to submit Form 'C' and 'D' would apply only to cases after May 11, 2002, following the amendment. The Court dismissed the appeal, reaffirming the prospective nature of the amendment.