- Home

- News

- Articles+

- Aerospace

- Agriculture

- Alternate Dispute Resolution

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- FDI

- Food and Beverage

- Health Care

- IBC Diaries

- Insurance Law

- Intellectual Property

- International Law

- Know the Law

- Labour Laws

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Technology Media and Telecom

- Tributes

- Zoom In

- Take On Board

- In Focus

- Law & Policy and Regulation

- IP & Tech Era

- Viewpoint

- Arbitration & Mediation

- Tax

- Student Corner

- AI

- ESG

- Gaming

- Inclusion & Diversity

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- News

- Articles

- Aerospace

- Agriculture

- Alternate Dispute Resolution

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- FDI

- Food and Beverage

- Health Care

- IBC Diaries

- Insurance Law

- Intellectual Property

- International Law

- Know the Law

- Labour Laws

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Technology Media and Telecom

- Tributes

- Zoom In

- Take On Board

- In Focus

- Law & Policy and Regulation

- IP & Tech Era

- Viewpoint

- Arbitration & Mediation

- Tax

- Student Corner

- AI

- ESG

- Gaming

- Inclusion & Diversity

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

Supreme Court rules an appellant has the right to disclosure of evidence

Supreme Court rules an appellant has the right to disclosure of evidence

The bench directed SEBI to red-act information that impinged on others privacy, but retain the information necessary for the appellant to defend himself

The Supreme Court has held that a noticee under the Securities and Exchange Board of India (SEBI) Prohibition of Fraudulent and Unfair Trade Practices (PFUTP) Regulations had the right to the disclosure of material that was relevant to the proceedings against him.

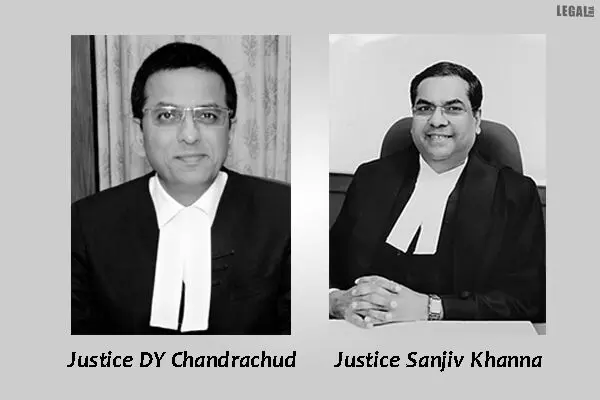

A bench of Justice DY Chandrachud and Justice Sanjiv Khanna also noted that the right was not absolute, and if SEBI was able to show that the disclosure would have an adverse effect, the burden of proving the necessity would move to the noticee.

The judges contended, "The respondent should prima facie establish that the disclosure of the report would affect third-party rights and the stability and orderly functioning of the securities market. The onus then shifts to the appellant to prove that the information is necessary to defend his case appropriately."

The appellant, among others, was suspected of being involved in misstating a company's financial affairs and received a show-cause notice from SEBI. He sought SEBI's investigation report, which was refused for several reasons including that it contained third party and sensitive market information.

The appellant, who stated that such non-disclosure was violative of principles of natural justice, challenged the notice.

The Supreme Court held that the noticee had a right to disclosure, subject only to the protection of the third-party rights. It took a balanced view and directed the respondents to make the report available with red-actions on the premise of the third party and market information.

The top court was hearing an appeal against an order of the Bombay High Court, which had upheld a show-cause notice issued without an investigation report under SEBI. The appellant had moved the high court against the notice. But the court had dismissed the petition, leading to the present appeal.

The Supreme Court bench established that as a default rule, all relevant material must be disclosed, and it would fundamentally be contrary to the principles of natural justice if relevant parts of the investigation report pertaining to the appellant were not disclosed. However, it emphasized that the actual test was whether the material was relevant for the purpose of adjudication.

"If it is, then the principles of natural justice require its due disclosure," the court said.