- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

Supreme Court rejects claim to replace BMW citing it beyond the insurance policy coverage

Supreme Court rejects claim to replace BMW citing it beyond the insurance policy coverage

Suggests that the insured must carefully read the terms of a policy, which determine the liability of the insurance company

The Supreme Court has reiterated that an insured cannot make a claim more than what was covered by the insurance policy.

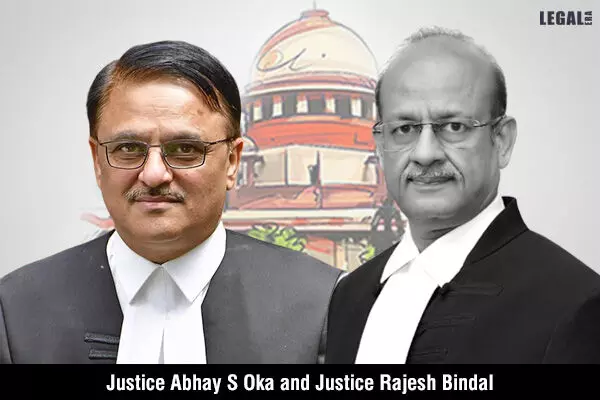

In the National Insurance Company Ltd. vs. Chief Electoral Officer case, the bench of Justice Abhay S Oka and Justice Rajesh Bindal held that the rule of contra proferentem was not applicable to a commercial contract such as a contract of insurance. The rule stated that if a clause in the contract was ambiguous, it must be interpreted against the party introducing it. However, for a contract of insurance, it would not apply, as it was bilateral and mutually agreed upon.

The owner of a BMW car met with an accident at Gurugram, Haryana, due to which the car was damaged beyond repair. He had taken two protections: One, a motor insurance policy of Bajaj General Insurance Company Ltd. (insurer). Two, the BMW Secure Advance Policy.

The owner contended that on a conjoint reading of the two policies if the car suffered damage of more than 75 percent of the Insured Declared Value (IDV), a new car must be provided.

He approached the State Consumer Disputes Redressal Commission, Delhi, which directed the insurer and BMW to indemnify the owner for a total loss of the BMW 3 Series 320D car by replacing it with a new vehicle of the same model.

The insurer and BMW approached the National Consumer Disputes Redressal Commission (NCDRC) which dismissed their appeals. Subsequently, they approached the top court.

The bench, while interpreting Clause (3) of the insurance policy of the insurer, held that an option was available to repair the vehicle or replace it.

It added, “In case of total loss/constructive total loss, instead of paying the amount as aforesaid, the insurer has an option available to replace the vehicle with a new one. However, it is not the right of the insured under the policy conditions to always claim replacement of the car. It was the option of the insurer.”

The Apex Court observed there was no specific provision in the policy for the replacement of a vehicle in case of a total loss or constructive total loss or theft. It held that BMW could be held liable under the BMW Secure when it was established that the insurer under the motor insurance policy accepted the case of total loss or constructive total loss of the vehicle.

While examining the issue of whether the repudiation of the insurance policy by the insurer was valid, the bench stated that there was no substance on the grounds of repudiation.

The judges held that there was a deficiency in service rendered by the insurer and BMW under Clause (g) of Section 2 of the Consumer Protection Act, 1986. Therefore, the owner of the vehicle was entitled to compensation from both.

As per Clause (3) of the motor insurance policy, the constructive total cost of the vehicle, the liability of the insurer, would not exceed the IDV of the vehicle, minus the value of the wreck. Thus, the amount payable by the insurer was quantified at Rs.25,83,012.45.

The bench stated that BMW had not pleaded that the vehicle of the same make was not available or the cost of the vehicle on that day. Therefore, a reasonable amount must be granted to the owner, on account of the difference in the value of the vehicle involved in the accident, and the value of a new car of the same model.

Accordingly, Justice Oka and Justice Bindal partly allowed the appeals. However, the direction of the State Commission, confirmed by the National Commission, to replace the car was substituted by a suggestion to pay monetary compensation. The insurer was directed to pay a difference of Rs.3,74,012 to the owner.