- Home

- News

- Articles+

- Aerospace

- Agriculture

- Alternate Dispute Resolution

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- FDI

- Food and Beverage

- Health Care

- IBC Diaries

- Insurance Law

- Intellectual Property

- International Law

- Know the Law

- Labour Laws

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Technology Media and Telecom

- Tributes

- Zoom In

- Take On Board

- In Focus

- Law & Policy and Regulation

- IP & Tech Era

- Viewpoint

- Arbitration & Mediation

- Tax

- Student Corner

- AI

- ESG

- Gaming

- Inclusion & Diversity

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- News

- Articles

- Aerospace

- Agriculture

- Alternate Dispute Resolution

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- FDI

- Food and Beverage

- Health Care

- IBC Diaries

- Insurance Law

- Intellectual Property

- International Law

- Know the Law

- Labour Laws

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Technology Media and Telecom

- Tributes

- Zoom In

- Take On Board

- In Focus

- Law & Policy and Regulation

- IP & Tech Era

- Viewpoint

- Arbitration & Mediation

- Tax

- Student Corner

- AI

- ESG

- Gaming

- Inclusion & Diversity

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

Supreme Court: Courts/Tribunals should Mandatorily Deposit Amounts Deposited by Litigants with Registry in Bank/Financial Institution

Supreme Court: Courts/Tribunals should Mandatorily Deposit Amounts Deposited by Litigants with Registry in Bank/Financial Institution

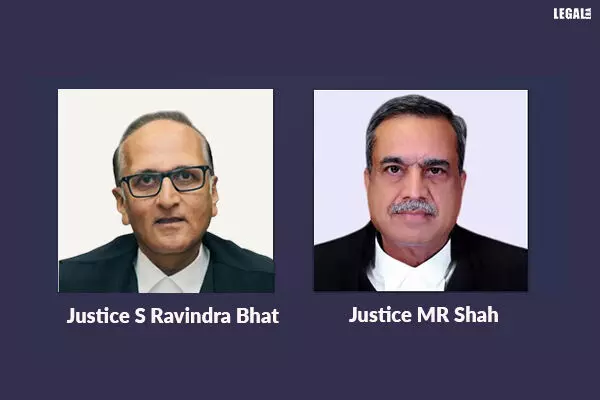

The Supreme Court by its division bench comprising of Justices MR Shah and S Ravindra Bhat issued important directions that all courts and judicial forums should frame guidelines in cases where amounts are deposited by the litigants with the office / registry of the court / tribunal such amounts should mandatorily be deposited in a bank or some financial institution, to ensure that no loss is caused in the future.

In the present case two appeals were preferred against a common order of the National Company Law Appellate Tribunal (in short NCLAT). The first by the original home buyer's legal representative (hereinafter, "complainant") and the second by the builder / developer (hereinafter, "developer"). The complainants had filed a case against the developer over delay in allotting a flat. The complainant had paid up to six installments, however denied to pay further installments since it contended that there was a delay in the progress of completion of construction.

Due to this the builder on 30th April, 2005 cancelled the allotment and along with the cancellation letter, the builder attached a Pay order dated 30th April, 2005 for Rs. 4,53,750 issued by Citibank towards full refund of payments made by the complainant.

Aggrieved by the same, the complainant filed a complaint under Section 36 of the Monopolies and Restrictive Trade Practices Act, 1969 (in short MRTP Act) alleging unfair trade practice by the developer. The MRTP Commission disposed off the application filed under Section 12A of the MRTP Act restraining the developer from creating third party interest with respect to the flat.

However, the MRTP Act was repealed by Section 66 of the Competition Act, 2002. Ultimately, the Competition Appellate Tribunal held that the complainant was entitled to compensation. The complainant had lost out on interest due to improper conduct.

The issue that came before the Apex Court was regarding the entitlement of interest for the complainant for the period from 30th April 2005. The developer defended stating that on 30th April 2005, the amount was deducted from its current account. As per evidence produced, Citibank also reported that since the amount was debited from the developer's account, the bank too did not receive any interest on that amount, during pendency of the proceedings.

The Court discerned, "the provisions of Order XXI Civil Procedure Code, 1908 (in short CPC) are applicable to decrees of civil court. However, they embody a sound policy principle, that if the amount is deposited, or paid to the decree holder or person entitled to it, the person entitled to the amount cannot later seek interest on it. This is a rule of prudence, inasmuch as the debtor, or person required to pay or refund the amount, is under an obligation to ensure that the amount payable is placed at the disposal of the person entitled to receive it. Once that is complete (in the form of payment, through different modes, including tendering a Banker's Cheque, or Pay Order or Demand Draft, all of which require the account holder / debtor to pay the bank, which would then issue the instrument) the tender, or 'payment' is complete".

The Court noted, the complainant could have sought for a deposit of the proceeds of the Pay Order in an account, to be maintained by the Registrar of the Commission; or prayed for appropriate orders that the amount be maintained by the developer, who could, in the event it became necessary, be directed to pay the principal along with such interest as the Commission or the Tribunal deemed appropriate and in the interests of justice or; could have sought for a 'without prejudice' order enabling her to encash the amount, and at the same time ensure that its claim was not defeated.

In these circumstances, the developer's argument that the rule embodied in Order XXI, Rule 4 CPC is applicable and was merited. The developer cannot be fastened with any legal liability to pay interest on the sum of Rs. 4,53,750 after 30th April 2005.

Lastly the Apex Court observed that, "that all courts and judicial forums should frame guidelines in cases where amounts are deposited with the office / registry of the court / tribunal, that such amounts should mandatorily be deposited in a bank or some financial institution, to ensure that no loss is caused in the future. Such guidelines should also cover situations where the concerned litigant merely files the instrument (Pay Order, Demand Draft, Banker's Cheque, etc.) without seeking any order, so as to avoid situations like the present case. These guidelines should be embodied in the form of appropriate rules, or regulations of each court, tribunal, commission, authority, agency, etc. exercising adjudicatory power."