- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

Supreme Court Clarifies: Repealed Provisions Cease Upon Repeal, Substituted Laws Effective Upon Substitution

Supreme Court Clarifies: Repealed Provisions Cease Upon Repeal, Substituted Laws Effective Upon Substitution

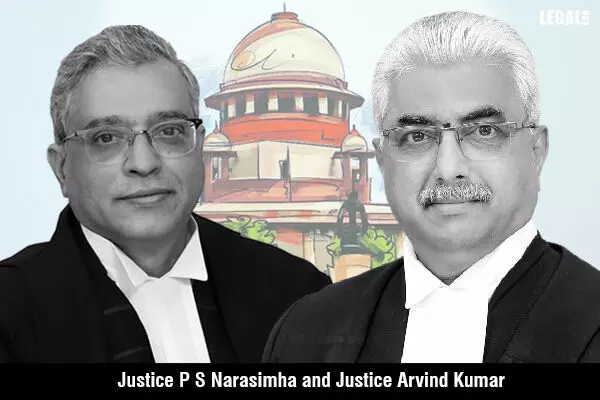

The Supreme Court, in a significant ruling, noted that, in accordance with statutory regulations, a provision that has been repealed ceases to have effect from the date of repeal, and the substituted provision comes into effect at the time of substitution.

Justice P. S. Narasimha stated, "The operation of repeal or substitution of a statutory provision is thus clear: a repealed provision will cease to operate from the date of repeal, and the substituted provision will commence to operate from the date of its substitution. This principle is subject to specific statutory prescriptions. The statute can enable the repealed provision to continue to apply to transactions that commenced before the repeal. Similarly, a substituted provision that operates prospectively, if it affects vested rights, subject to statutory prescriptions, can also operate retrospectively."

The case involves the appellant acting as a sub-licensee under the M.P. Excise Act, 1915, for the manufacture, import, and sale of Foreign Liquor. These activities were governed by the Madhya Pradesh Foreign Liquor Rules, 1996. The relevant rules for the present case are Rules 16 and 19. Rule 16 outlined the acceptable thresholds for liquor loss during transit, while Rule 19 stipulated penalties for violations of this rule.

During the license period of 2009–10, the breach occurred. The penalty imposed for this breach amounted to approximately four times the maximum duty payable on foreign liquor. However, no action was taken against the appellant during this period.

Following an amendment in March 2011, Rule 19 underwent substitution. Consequently, the penalty was reduced from four times the maximum duty payable to an amount not exceeding the duty payable on foreign liquor. Subsequent to this change, a notice was issued to the appellant, demanding payment of the penalty in accordance with the previous Rule 19.

The intriguing question for adjudication revolved around whether the penalty should be imposed in accordance with the old rule or the substituted one.

After multiple rounds of litigation, the Division Bench of the High Court ruled that the rule in effect during the license year must be applied. Additionally, the Court reasoned that the determination of the penalty constitutes substantive law and therefore cannot operate retrospectively. Dissatisfied with this decision, the matter was escalated to the Supreme Court.

Initially, the Division Bench, comprising Justices Narasimha and Aravind Kumar, noted that the objective of the amendment is to strike a proper balance between crime and punishment. Following these observations, the Court remarked that the functioning of subordinate legislation differs slightly as they are contingent on the parent act.

“The principle governing subordinate legislation is slightly different in as much as the operation of a subordinate legislation is determined by the empowerment of the parent act…Without a statutory empowerment, subordinate legislation will always commence to operate only from the date of its issuance and, at the same time, cease to exist from the date of its deletion or withdrawal.,” the Court added.

Building upon this legal foundation, the Court referenced Section 63 (Publication of Rules and Notifications) of the Act. It was observed that according to this provision, the repealed provision would not govern rights and obligations that arose while it was in force.

The Court added that Section 63 of the M.P. Excise Act, 1915, only empowers the government to promulgate subordinate legislation with effect from a specified date. In this regard, the Court also highlighted that no other date had been notified regarding when the substituted Rule 19 would come into effect.

Highlighting the intention behind the amendment, the Court emphasized that it should be seen in the context of promoting good governance and efficient management. Additionally, the Court noted that liquor regulation necessitates close monitoring.

“If the amendment by way of a substitution in 2011 is intended to reduce the quantum of penalty for better administration and regulation of foreign liquor, there is no justification to ignore the subject and context of the amendment and permit the state to recover the penalty as per the unamended rule. The court stated.

The Court also dismissed the state's contention that the substituted rule cannot have retrospective effect. It reasoned that since the Rule, amended in March 2011, was applied to a case initiated with the issuance of the demand notice in November 2011, it operates retrospectively. This prevents the arbitrary classification of offenders into two categories without serving any purpose.

Prior to allowing the present appeal, the Court stressed the significance of interpreting laws in a straightforward and clear manner, considering their intended purpose. Based on this reasoning, the court concluded that the penalty should be imposed according to the substituted law.