- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

Supreme Court Affirms Corporate Entities' Right To File Consumer Complaints Under Consumer Protection Act 1986

Supreme Court Affirms Corporate Entities' Right to File Consumer Complaints under Consumer Protection Act 1986

In a noteworthy development, the Supreme Court has ruled that corporate entities/companies would not be prohibited under the old Consumer Protection Act of 1986 from being considered as 'persons' eligible to file a consumer complaint.

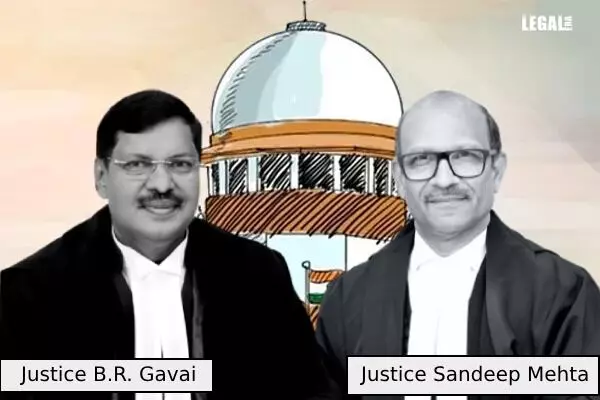

Overturning the decision of the National Consumer Disputes Redressal Commission, the Bench consisting of Justices B.R. Gavai and Sandeep Mehta noted that while the term 'person' may not explicitly mention corporate entities, the inclusive definition of 'person' under the 1986 Act extends to encompass corporate entities/companies as eligible entities to file an insurance claim.

The case relates to the invalidation of the fire insurance claim amounting to Rs. 3.31 crores by the insurance company and the National Consumer Disputes Redressal Commission (NCDRC).

Before the Supreme Court, the respondent insurance company argued that the appellant's claim was not viable because, as a corporate entity operating for commercial purposes, it did not meet the necessary criteria to be considered a 'person' under Section 2(m) of the Consumer Protection Act, 1986.

Dismissing this argument, the Supreme Court asserted that the insured appellant's claim cannot be dismissed solely on the basis of not meeting the requirements outlined in Section 2(m) of the 1986 Act. The court clarified that the definition of 'person' in the 1986 Act is inclusive, not exhaustive, and thus encompasses 'company' within its scope.

“The very fact that in the Act of 2019, a body corporate has been brought within the definition of 'person', by itself, indicates that the legislature realized the incongruity in the unamended provision and has rectified the anomaly by including the word 'company' in the definition of 'person'. Hence, the first preliminary objection raised by learned counsel for the respondent regarding 'company' not being covered by the definition of 'person' under the Act of 1986 has no legs to stand and deserves to be rejected," the court said.

The court observed that the insurance policy in question, titled 'Standard Fire and Special Perils Policy (Material Damage),' specifically covered risks related to fire and other specified perils. Additionally, the claim filed by the insured-appellant was for indemnification due to damage caused by a fire accident at the insured premises. Consequently, the court concluded that both preliminary objections raised by the respondent's counsel were unsustainable.

The court observed that the insured-appellant had raised a significant plea in the civil appeal, stating that they were not provided copies of the surveyor's report and the investigators' report. This lack of timely provision denied them the opportunity to effectively rebut the reports. The court noted that this plea was not specifically refuted by the insurer-respondent, who only offered a formal denial in their counter-affidavit.

The court held that it was crucial for the insured-appellant to have been given a fair opportunity to provide their rebuttal or objections to the reports submitted by the insurer-respondent before the National Commission. Consequently, the court ordered that the complaint should be re-evaluated based on its merits after granting the appellant such an opportunity.