- Home

- News

- Articles+

- Aerospace

- AI

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- ESG

- FDI

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- News

- Articles

- Aerospace

- AI

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- ESG

- FDI

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

Delhi High Court in Antrix-Devas Deal Upholds Single- Judge Order Setting Aside ICC Award on Grounds of ‘Fraud’ and Against ‘Public Policy’

Delhi High Court in Antrix-Devas Deal Upholds Single- Judge Order Setting Aside ICC Award on Grounds of ‘Fraud’ and Against ‘Public Policy’

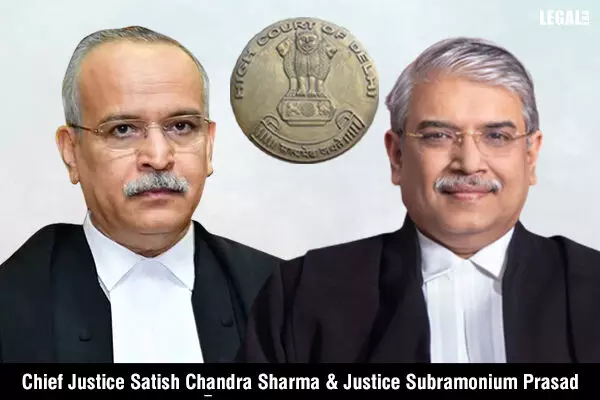

The Delhi High Court by its division bench of Chief Justice Satish Chandra Sharma and Justice Subramonium Prasad upheld a single-judge order setting aside the arbitral award which had directed Antrix Corporation Limited (commercial arm of ISRO) to pay damages of over US dollar 560 million along with interest to Devas Multimedia Private Limited.

The bench dismissed the appeal filed by Devas Employees Mauritius Private Limited against the single-judge order.

In the present case a contract was entered into between Antrix and Devas on 28 January, 2015 for the Lease of Space Segment Capacity on ISRO/Antrix S-band Spacecraft.

The contract was executed between Antrix and Devas only and neither the Department of Space nor ISRO nor any other governmental agency was a party to the Contract.

According to the contract, Antrix was entrusted with building, launching and operate two satellites and lease spectrum capacity on those satellites to Devas, which Devas planned to use to provide digital multimedia broadcasting services across India. In return, Devas agreed to pay to Antrix Upfront Capacity Reservation Fees of US Dollar 20 million per satellite, and lease fees of US Dollar 9 million to US Dollar 11.25 million per annum.

Thereafter, Antrix had notified Devas that the contract was terminated inter alia citing Article 11 (Force Majeure) and Article 7(c) (Termination for convenience by Antrix) of the Contract. Devas refused to accept the termination and instead claimed specific performance of the contract and in the alternative claimed damages to the tune of US Dollar 1.6 billion.

The termination of the Devas Agreement by Antrix was disputed by Devas which invoked Article 20(a) of the Devas Agreement to refer the dispute to the senior management of both the parties. However, on 15 April 2011, Antrix wrote to Devas referring to the letter of termination of the Devas Agreement and enclosed with it a cheque of INR 58,37,34,000 (approximately US Dollar 13 million) as reimbursement of the Upfront Capacity Reservation Fee (UCRF) already paid by Devas under the Devas Agreement. Devas, returned the cheque and wrote to Antrix stating that it had failed to state a proper basis for termination of the Devas Agreement.

Eventually, on 1 July, 2011, Devas initiated arbitration proceedings against Antrix under the rules of the International Chambers of Commerce (ICC), seeking damages for repudiatory breach of the Devas Agreement by Antrix.

Vide the impugned order, the Arbitral Tribunal had held that the contract between the parties did not limit Devas' entitlement to alleged damages that it suffered by reason of Antrix's repudiation of the agreement. The Tribunal thus directed Antrix to pay US Dollar 562.2 million to Devas besides interest.

The Arbitral Tribunal had held that the decision of declining the grant of orbital slot to Antrix was a decision of a governmental authority in exercise of its sovereign function and amounted to a Force Majeure event and covered under Article 11(b). Thus, it could not have held that the alleged breach on the part of Antrix was delibrate.

The question which arose for consideration was whether the learned Single Judge was correct in setting aside the award by primarily relying on the findings of the Apex Court in Devas Multimedia Private Limited vs. Antrix Corporation Limited and Another (2022).

The division bench asserted that the act of fraud is an anathema to all equitable principles and every transaction tainted with fraud must be viewed with disdain by Courts.

In this regard the Court observed, “in the instant case, the Supreme Court in the Civil Appeal has held that the commercial relationship between Devas and Antrix is a product of fraud, and as a consequence, the Devas Agreement, the ICC Award, and all other disputes arising out of the transaction would be tainted by fraud. Permitting Devas and its shareholders to reap the benefits of the ICC Award would amount to this Court perpetuating the fraud. Such a view would be against all principles of justice, equity and good conscience.”

Further, on perusal of records the Court found that the Cabinet was misled to believe there are several firm expressions of interest before ISRO, even though the agreement was granted only to Devas.

The Court noted that Devas has thus not only suppressed, but also misrepresented information in order to pursue its fraudulent activities in India.

Further, referring to the facts of the case, the Court was of the view that there was clearly established that the fraudulent conduct of Devas begins from the very incorporation of the company and extends to the Devas Agreement, in its entirety, and all other actions pursued by it.

The bench expressed, “the nature of fraud is so serious and complex that it not only resulted in the company being wound up under the Companies Act, 2013, but also led to a criminal investigation against the company and its officers. The Devas Agreement itself has been obtained through the process of fabrication of documents and misrepresentation and constitutes a clear case of fraud. Such is the extent of the fraud that it permeates through every agreement, transaction or award entered into by Devas.”

The fraud propagated by Devas was not only against Antrix, but against the State as a whole, inasmuch as it attempts to obtain monetary benefits from the State itself, by attempting to enforce an arbitral award, which itself was arising out of fraud. A fraud of such scale would certainly render the award to be in conflict with the public policy of India, opined the bench.

Further, with respect to Article 144 of the Constitution of India mandates every authority to aid in enforcing the orders and decrees of the Supreme Court, the bench was of the considered view that after such finding by the Apex Court, it was not open for the single judge to come to the conclusion that the award and would be against the spirit of Article 144 of the Constitution, which has been held to be a product of fraud, would still be enforceable in the country.

The bench stated that such an interpretation would be absurd and would lead to disastrous outcomes and asserted that a party which commits such fraud or deception cannot be permitted to reap its benefits, especially by taking advantage of the judicial process, including in subsequent or collateral proceedings, as doing so would result in the Court enabling the perpetuation of fraud.

In addition to this, the division bench emphasized that the findings of the Apex Court, therefore, become the ratio and not the obiter of the case and therefore, were binding on the learned Single Judge under Article 141 of the Constitution of India, as it is settled law that even obiter of a judgment of the Hon’ble Supreme Court is binding on all Courts subordinate to it.

The Apex Court in Peerless General Finance and Invest Company Ltd. v. CIT, (2020) had reiterated that though the focus of the Apex Court may not be directly on a particular point, yet, a pronouncement by the Apex Court, even if it cannot be called the ratio decidendi of the judgment, will still be binding on the High Courts.

The Court with respect to the issue of Court’s power under section 34(2)(b) of Arbitration and Conciliation Act, 1996 to set aside an award without any specific pleadings noted that the phrase “the Court finds that” in sections 34(2)(b) and 34(2A) of the Act allows the Court to look into the arbitral award and discover the grounds mentioned under both the provisions.

According to the bench, the phrase in questions enables the Court to discover suo motu as to whether an award is in conflict with the public policy of India.

The Court held that, “as a corollary, having regards to Explanation 1(i) of Section 34(2)(b) of the Arbitration Act, it follows that the Court would also have the power to discover on its own whether the making of an award is induced or affected by fraud or corruption or is in violation of Section 75 or 81 of the Arbitration Act.”

The Court concluded that it would be against the principles of justice, equity and good conscience to permit Devas to reap the benefits of the ICC Award, adding that allowing the same would amount to perpetuating the fraud by Court.

Thus, the division bench stated that learned Single Judge had not made an error in setting aside the ICC Award on the grounds of fraud and it being in conflict with the public policy of India and dismissed the appeal.