- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

Bombay High Court upholds ITAT's order under IT Act

Bombay High Court upholds ITAT's order under IT Act

The case pertained to two projects - Kumar Shantiniketan and Kumar Kruti

The Bombay High Court has upheld the order of the Income Tax Appellate Tribunal (ITAT) directing the assessing officer (AO) to work out the pro rata deduction under the Income Tax Act, 1961.

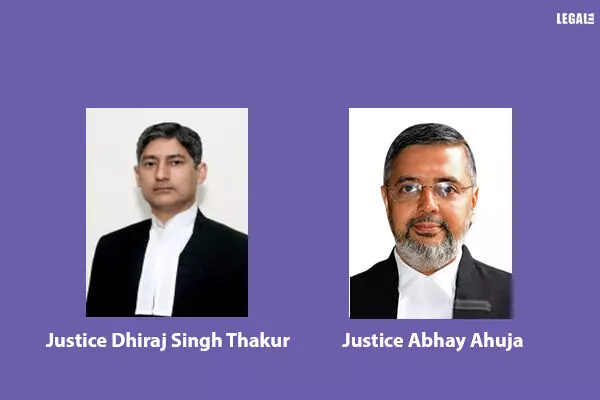

The division bench of Justice Dhiraj Singh Thakur and Justice Abhay Ahuja observed that Section 80IB (10) is nowhere even remotely aimed to deny the benefit of the deduction. This was regarding a residential unit, which otherwise confirmed the requirement of the size at the cost of an ineligible residential unit with a built-up area of more than 1500 sq. ft.

The respondent/assessee is a firm engaged in the business of developing residential projects in Pune. The Income Tax Return (ITR) for the Assessment Year 2011-12 was filed in September 2011, declaring a total income after claiming the deductions under Section 80IB (10) of the IT Act. This pertained to two projects - Kumar Shantiniketan and Kumar Kruti.

During the assessment proceedings, the AO noted that two flats in Kumar Shantiniketan had an area more than the prescribed limit of 1500 sq. ft., which was a mandatory requirement for claiming the deduction under the IT Act.

As for Kumar Kruti, the AO noted that eight flats had an area greater than the permissible 1500 sq. ft. He also noted that the assessee had failed to complete the project by 31 March 2008. It held that Kumar Kruti was part of a larger project, Kumar City, sanctioned in August 2003. The AO, thus, disallowed the claim of deduction under the IT Act.

The assessee challenged the order of the AO before the Commissioner of Income Tax (Appeals). The AO was told to allow the pro rata deduction in respect of the eligible flats not exceeding the prescribed limit of a covered area of 1500 sq. ft.

The order was then challenged by the department before the Pune bench of ITAT, which dismissed the appeal.

The question before the high court was whether ITAT was justified in allowing the assessee's claim for deduction under Section 80IB (10) on a pro-rata basis, given that he had not met the limit on the built-up area in the projects.

Section 80IB (10) allows an undertaking, developing, and building housing projects, to claim a 100 percent deduction of the profits derived from the housing projects subject to the fulfilment of the timeline as regards the approval of the project, its commencement, and completion as prescribed in Sub-clause (a) of Section 80IB (10).

The fulfilment of the condition of the size of the plot of land in terms of Sub-clause (b) of Section 80IB (10), or the compliance as regards the built-up area of the residential unit is not more than 1500 sq. ft. in any place other than the city of Delhi or Mumbai.

As per clause (c) of Section 80IB (10) the residential unit has a maximum built-up area of 1000 square feet where the residential unit is situated within the city of Delhi or Mumbai or within 25 kilometres from the municipal limits of these cities and 1,500 square feet at any other place.

The appellant contended that Section 80IB (10) did not at all envisage a pro-rata deduction in respect of the eligible flats. Even if a single flat in a housing project was found to exceed the permissible maximum built-up area of 1500 sq. ft., the assessee would lose the right to claim the benefit of deduction of the entire housing project.

The appeal was, thus, dismissed by the court.