- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

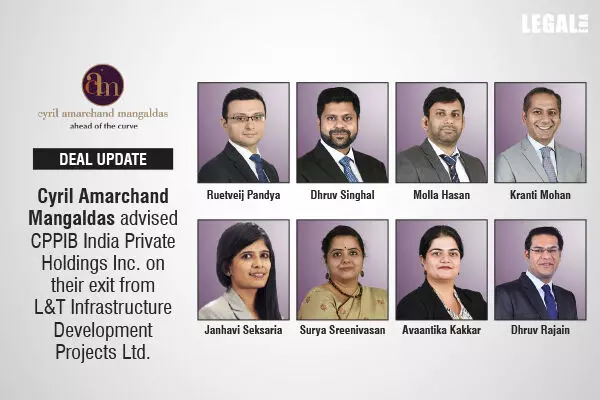

Cyril Amarchand Mangaldas Advised CPPIB India Private Holdings Inc. On Their Exit From L&T Infrastructure Development Projects Ltd.

Cyril Amarchand Mangaldas Advised CPPIB India Private Holdings Inc. On Their Exit From L&T Infrastructure Development Projects Ltd.

Cyril Amarchand Mangaldas (CAM) advised CPPIB India Private Holdings Inc. (CPPIB) on their exit from L&T Infrastructure Development Projects Limited (IDPL). This is first of its kind transaction that involved the de-classification of IDPL as a sponsor of Interise Trust (formerly known as IndInfravit Trust) (InvIT) and the consequent conversion of InvIT’s investment manager, Interise Investment Managers Limited (IIML) into a self-sponsored investment manager. This is the first transaction since the August 2023 amendment of the SEBI (Infrastructure Investment Trusts) Regulations, 2014 (InvIT Regulations) where the construct of self-sponsored Investment Manager was introduced.

IDPL was a 49-51 joint venture between CPPIB and Larsen and Toubro Limited (L&T). CPPIB exercised its tag-along right to sell its stake in IDPL along with L&T to Epic Concesiones Private Limited (an entity managed by Edelweiss Alternative Asset Advisors Limited) (Epic) by way of the share purchase agreement dated December 16, 2022 (Transaction). IDPL is an active participant in the Indian infrastructure space, with more than 13 special purpose vehicles (SPVs) in the road sector and was also the sponsor of the InvIT (India's first privately placed infrastructure investment trust). A subsidiary of IDPL, Kudgi Transmission Limited (KTL) was separately acquired by other Edelweiss entities, as part of the transaction.

CAM team played a crucial role in facilitating a complex transaction, advising on the exit of CPPIB from IDPL via sale of their entire shareholding in IDPL. This included finalization of numerous transaction documents and advising on nuanced deal structuring. The transaction also involved a framework agreement for settlement of all claims and rights and obligations of the InvIT vis-à-vis IDPL, and novation of other liabilities to L&T. CAM adeptly managed the regulatory process, securing approvals from entities such as CCI and NHAI. Additionally, the team also assisted in integrating the intricate integration requirements for converting InvIT’s investment manager to self-sponsored investment manager, including de-classification and disassociation of IDPL as the sponsor of the InvIT.

The General Corporate team of Cyril Amarchand Mangaldas provided advisory services for the transaction. Leading the deal were Ruetveij Pandya, Dhruv Singhal, and Molla Hasan, Partners, supported by Abhilasha Malpani Principal Associate, Vishvas Bharadwaj Senior Associate, and Aparajita Kaul and Khushi Maheshwari Associates.

Kranti Mohan, Partner & Head of REITs and InvITs, and Janhavi Seksaria, Partner, were assisted by Mrudul Desai Principal Associate and Vanya Agarwal Associate for InvIT-related advisory.

Surya Sreenivasan, Partner, with support from Anand Deshpande, Principal Associate, Handled Project Finance Aspects, while Avaantika Kakkar, Partner & Head of Competition Law, and Dhruv Rajain, Partner, along with Shivani Sathe Senior Associate and Svyambhuv Talwar Associate, Provided Guidance on Competition Law Matters.

Other parties and advisors involved in the transaction included Ambit Private Limited, acting as advisor for CPP Investments; KPMG, serving as advisor for CPP Investments; Edelweiss Alternative Assets Advisors Limited, acting as the buyer; and L&T, acting as the seller.

The signing date was 16th December 2022; and closed by 10th April, 2024.