- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

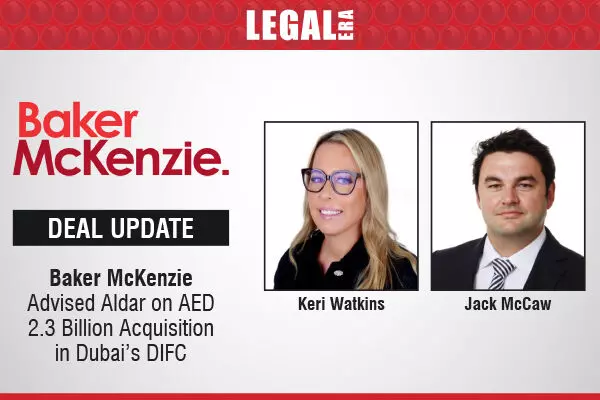

Baker McKenzie Advised Aldar On AED 2.3 Billion Acquisition In Dubai’s DIFC

Baker McKenzie Advised Aldar on AED 2.3 Billion Acquisition in Dubai’s DIFC

Baker McKenzie has successfully advised Aldar, a leading Abu Dhabi-based real estate developer, investor, and manager, on its acquisition of a premier commercial office and retail tower in the Dubai International Financial Centre (DIFC). The AED 2.3 billion (USD 626 million) transaction marks one of the largest commercial tower acquisitions in the DIFC and strengthens Aldar’s position as a key player in the UAE’s real estate sector. The tower, acquired from H&H Development, is expected to become operational in 2028.

This landmark deal makes Aldar the only UAE developer with commercial properties in both of the country’s major financial hubs—Abu Dhabi Global Markets (ADGM) and the DIFC. It also reflects Aldar’s commitment to scaling its Grade A commercial portfolio and expanding its presence in Dubai’s financial district.

Keri Watkins, Co-Head of Baker McKenzie's Real Estate and Hospitality Practice Group in the Middle East, Aldar Relationship Partner and lead partner on the transaction, commented: “Aldar's investment in a prime location within the DIFC represents a significant milestone in Aldar's growth, and we are really proud to have supported the team on this exciting deal. This acquisition not only strengthens Aldar's presence in Dubai but also underscores their commitment to expanding their portfolio in key financial districts, enhancing their strategic growth and investment in the region."

The Baker McKenzie team advising on the transaction was led by Partner Keri Watkins and Senior Associate Jack McCaw, with additional support from the firm’s regional real estate and corporate teams.

Click toknow more about Baker McKenzie