Milbank Advised Underwriters On Verizon’s $2.25 Billion Notes Offering

Global law firm Milbank LLP has guided the underwriters on Verizon’s offering of $2.25 billion 5.250 percent notes due 2035;

Milbank Advised Underwriters On Verizon’s $2.25 Billion Notes Offering

The repurchase and pension fund contribution is a first-of-its-kind in the market for debt subscriptions

Global law firm Milbank LLP has guided the underwriters on Verizon’s offering of $2.25 billion 5.250 percent notes due 2035.

It included an allocation of notes for repurchase by Verizon and on-delivery to its pension fund, Bell Atlantic Master Trust.

The proceeds will be allocated for general corporate purposes, including paying the redemption price for $984,778,000 of Verizon’s 2.625 percent notes due 2026.

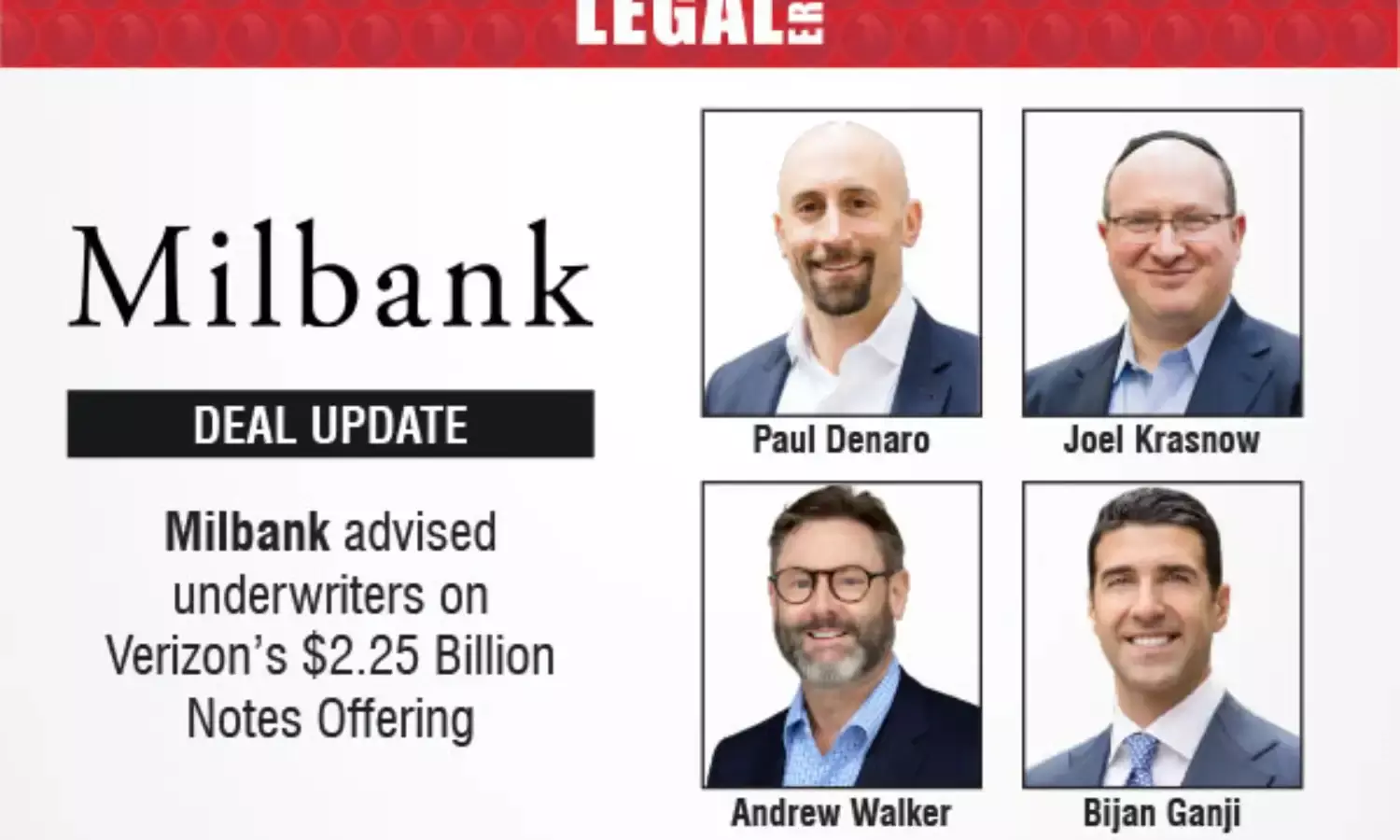

The Milbank deal team was led by Corporate Finance and Securities partner Paul Denaro with associates Abir Varma, Adnene Gargouri and Jillian Ran.

The team included Executive Compensation and Employee Benefits partner Joel Krasnow, Tax partner Andrew Walker, associate Michelle Song and Global Risk & National Security partner Bijan Ganji and associate Lauren Trushin.

If you have a news or deal publication or would like to collaborate on content, columns, or article publications, connect with the Legal Era News Network Team and email us at info@legalera.in or call us on +91 8879634922.