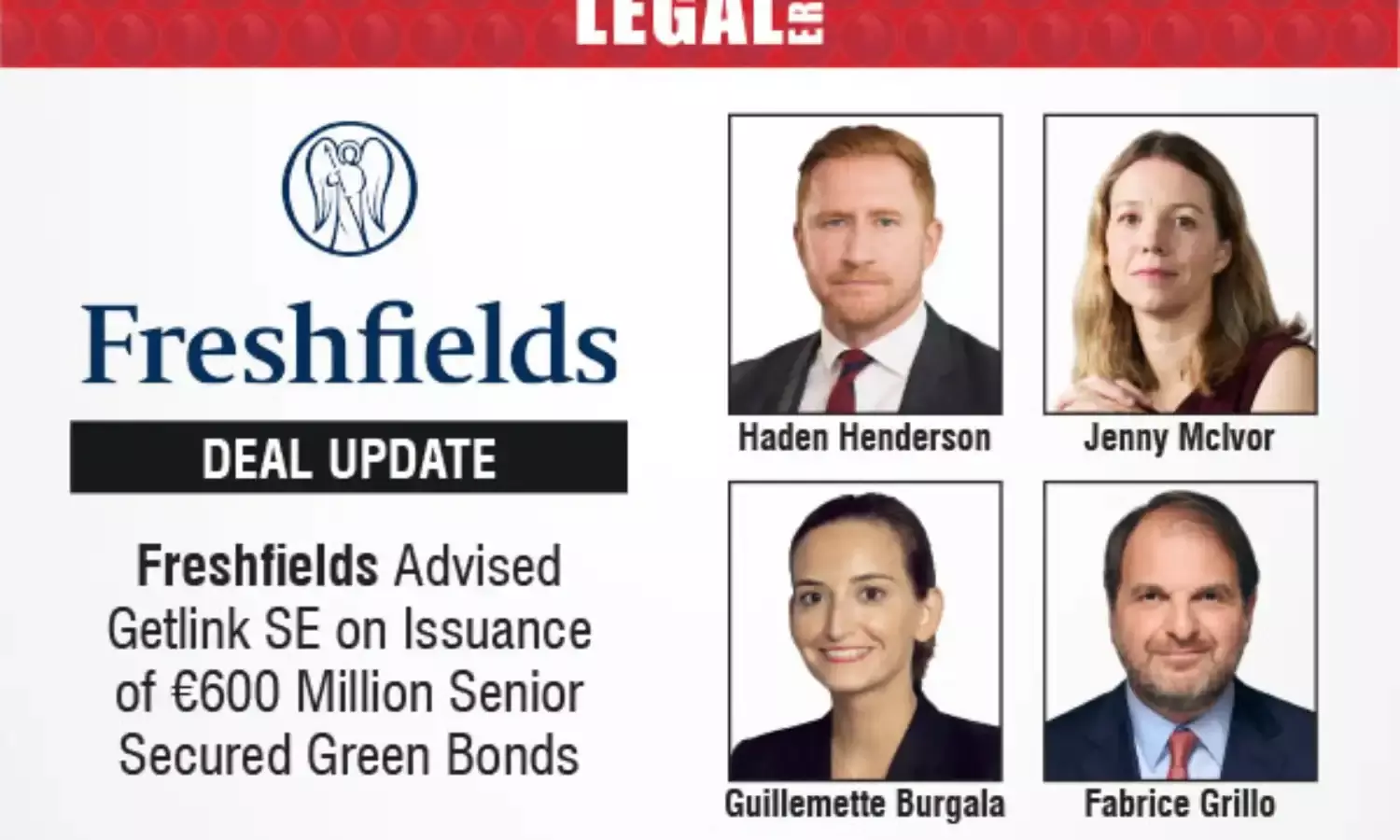

Freshfields Advised Getlink SE On Issuance Of €600 Million Senior Secured Green Bonds

More than 518 million people and 106 million vehicles have travelled through the Channel Tunnel since its opening in 1994.;

Freshfields Advised Getlink SE On Issuance Of €600 Million Senior Secured Green Bonds

More than 518 million people and 106 million vehicles have travelled through the Channel Tunnel since its opening in 1994.

Global law firm Freshfields has represented Getlink SE (Getlink) in its offering of €600 million senior secured green notes due 2030. Successfully priced on March 27, 2025 the notes closed on April 4, 2025. Getlink used the proceeds of the issuance and cash on its balance sheet to restore its existing €850 million senior secured green notes due October 2025.

Through its subsidiary Eurotunnel, Getlink is the concession holder for Channel Tunnel Infrastructure till 2086 and operates Truck Shuttles and Passenger Shuttles (cars and coaches) between Folkestone (UK) and Calais (France). Eurotunnel has been developing the smart border since December 31, 2020 to ensure that the Tunnel remains the fastest, most reliable, easiest and most environmentally friendly way to cross the Channel. More than 518 million people and 106 million vehicles have travelled through the Channel Tunnel since its opening in 1994. This unique land link carries a quarter of the trade between the Continent and the United Kingdom and has become a crucial link reinforced by the Tunnel’s ElecLink electricity interconnector which helps balance energy needs between France and the United Kingdom.

Leveraged finance and Capital Markets Partner Haden Henderson and infrastructure Finance Partner Jenny Mclvor alongside Senior Associate Katy Foxall, and Associates Laura Hutchinson and Enzo Paganetti led the Freshfields team. French law matters were led by Partners Guillemette Burgala and Fabrice Grillo, alongside Counsel Aïleen Legré, and Associates Samvel Der Arsenian, Aia Eid, Marwan Hammache and Lucas Cloarec.

The transaction represents another example of a market leading transaction by Freshfields’ cross-border capital markets team, which has established a reputation for providing strategic, commercial and practical guidance on the most challenging and complex bond offerings worldwide.

If you have a news or deal publication or would like to collaborate on content, columns, or article publications, connect with the Legal Era News Network Team and email us at info@legalera.in or call us on +91 8879634922.